Use of Virtual wallets in Colombia reached a wide level of massification. According to Kushki data, eight out of every 10 Colombians have a digital payment application in 2023, and among them there are brands such as Nequi, Daviplata or Dale.

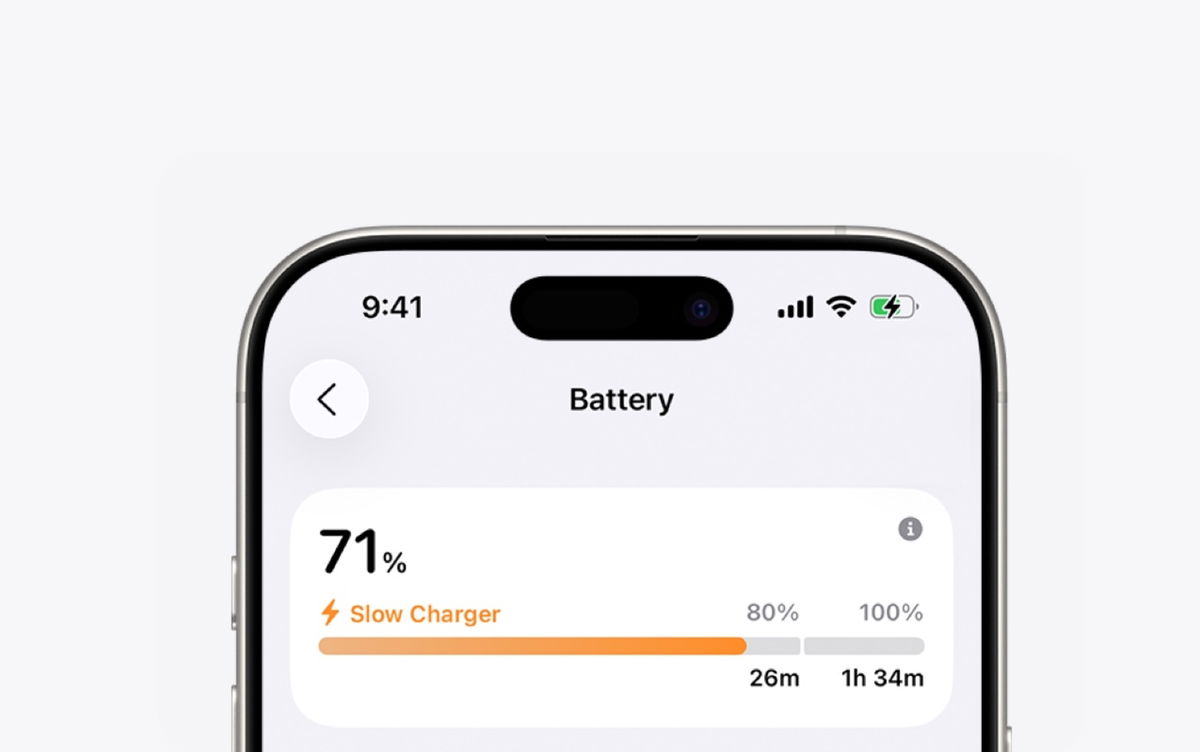

But, There is still a lot of room for growth and opportunity in this market. especially for a large percentage of the population who are unbanked or have technical limitations (e.g. type of mobile phone) to install and support the virtual wallet application.

(

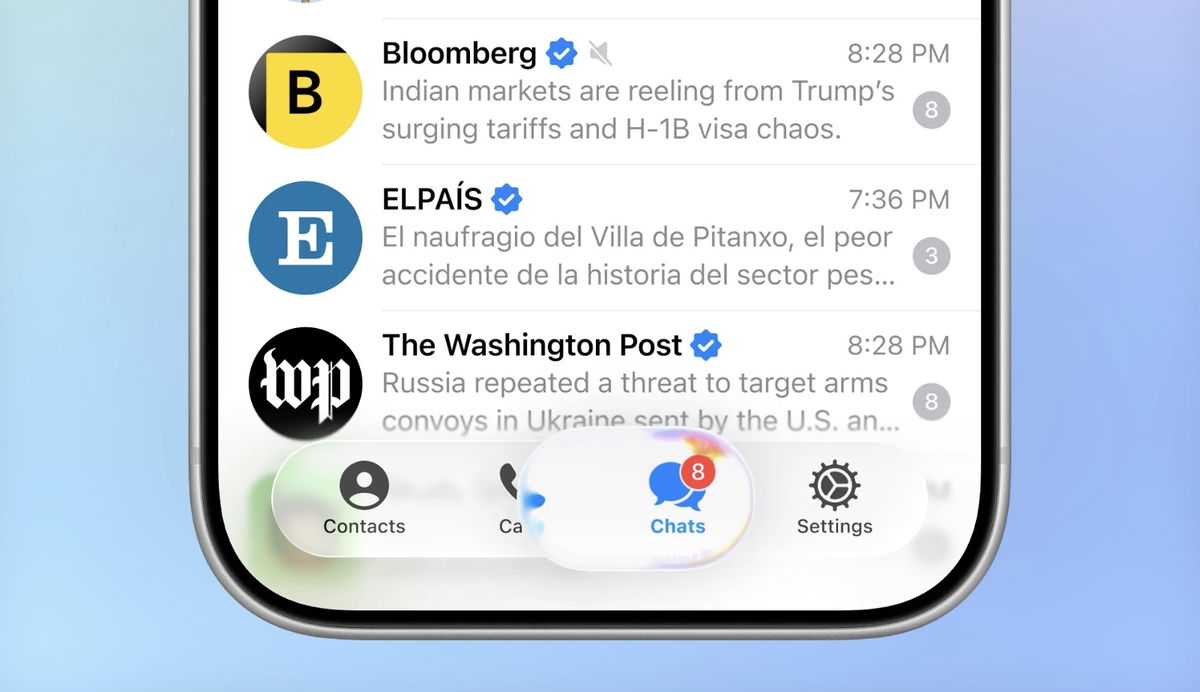

Thinking about it is TPaga, one of the trading platforms with the largest projection in Colombia and many Latin American countries, decided to announce a service integrated with WhatsApp. It will bring all the financial potential offered by its platform to the most popular and widely used application.

According to Andrés Gutiérrez, CEO and founder of TPaga, “Many transaction services in Asia are provided through messaging platforms.” They found this opportunity because they were working with a bank in Guatemala, where they chose TPaga as the platform behind a new banking and payment service for coffee farmers in the city of Antigua.

Right now, TPaga is a financial platform that offers various services to its users: open a bank account, pay bills, transfer money to Colombia and other countries, buy insurance (it has agreements with several insurance companies), request a loan and deposit money into a collective fund.

“2003 was a year of growth for us. Between TPaga and ‘white label’ wallets, we went from 250,000 to one million transactions per month with 3.5 million users,” says Gutiérrez, referring to financial apps that contract with TPaga but have their own banking brand for customers.

On that road Virtual wallets are on their way to becoming ‘super applications’. Concept describing applications that are born with a single service, but begin to integrate others until they become a kind of ‘Swiss army knife’ with a variety of functionalities and tools.

“I think the consumer is saturated with apps, and getting them to download a new app is not as easy as it was three or four years ago. That’s why some of them are turning into ‘super apps’. Today it is more convenient for an application to launch new services than to launch individual applications,” explains Andrés Gutiérrez.

For this reason WhatsApp application used by 9 out of 10 ColombiansWith 350 million users across Latin America, it becomes an ideal platform to inject financial and transactional potential with a wallet like TPaga.

(You may be interested in: ‘LuzIA’ on WhatsApp: this way you can know what the voice note says without listening to it)

According to Andrés Gutiérrez, WhatsApp has all the potential to help a person make transactions such as purchases and transfers: “The entire TPaga offering will be on WhatsApp. Some tasks will be easier, such as transferring money to a WhatsApp contact via resources in the wallet. “Renewing a Soat, for example, is an experience easily achieved through chat and a few clicks,” he explains.

Will wallets replace banks and their apps? TPaga CEO does not believe this: “They will complement each other in the long run, just like QR code payments, which do not replace cards. There will be a market, shops and people who prefer one or the other. This is what I see Turning WhatsApp into a banking platform will help an underserved and unbanked segment of the population“he explained.

(

For a few weeks, the functionality of using TPaga with WhatsApp will be limited to a few users.

Pay Rechargeable with Efecty points or electronically with any bank through PSE.

100,000 users will be added weekly to WhatsApp functionality. There are already 25,000 users making transfers via WhatsApp with TPaga, For example.

An action with TPaga on WhatsApp works like chatting with a person. It is essentially a bot that guides a person step by step to transfer money, buy insurance, or pay for a good or service in a natural and simple way.

JOSÉ CARLOS GARCÍA R.

Multimedia Editor

@JoseCarlosTecno on social networks

Source: Exame