Elon Musk lost $30 billion in two days. This happened after Tesla reported for the third quarter.

Investors, analysts and the media note that this is one of Tesla’s most developed quarters in terms of the country’s economic development, and financial results do not correspond to already negative forecasts.

The situation is further complicated by Musk’s disappointing comments regarding the future of Tesla and new electric vehicles.

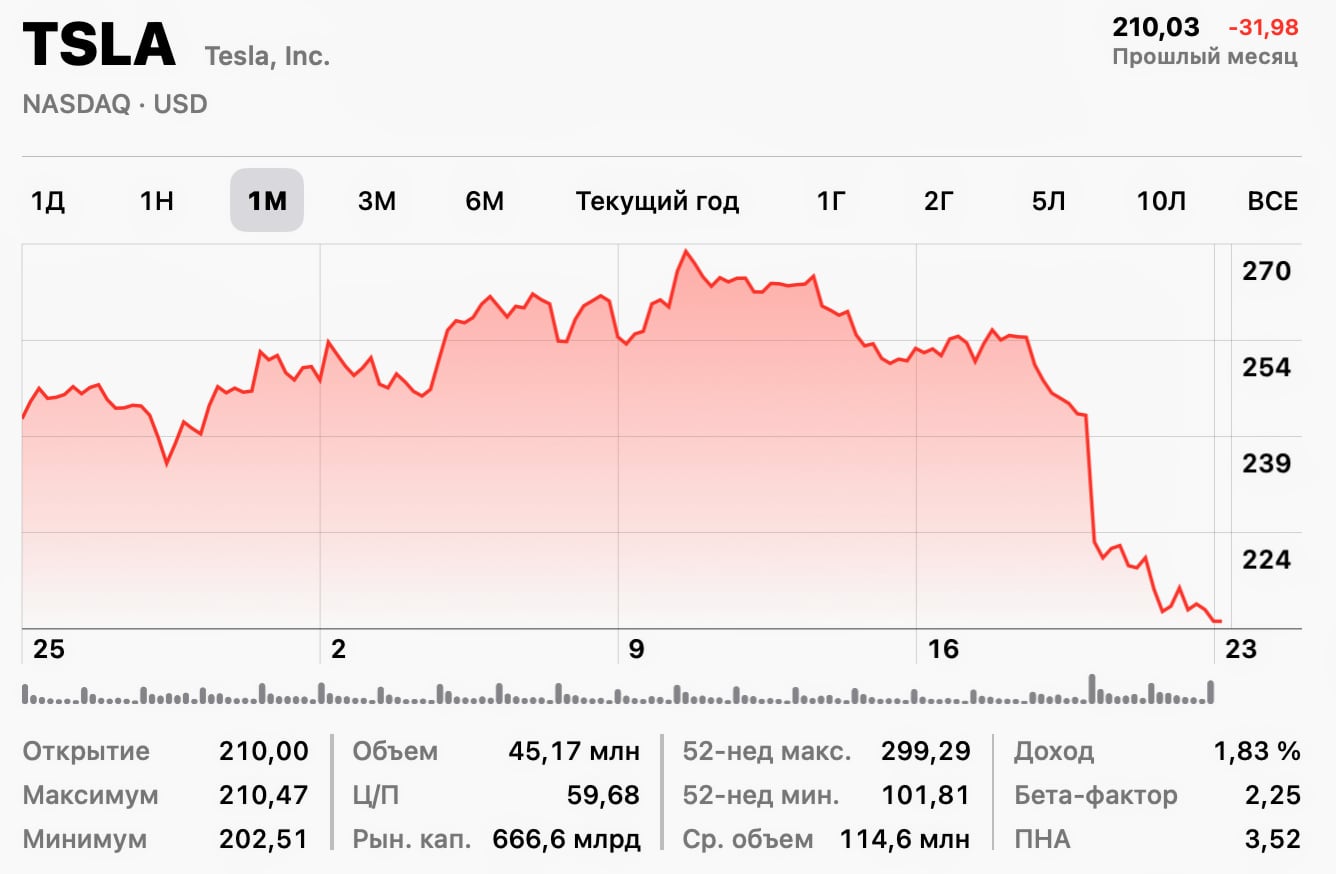

Tesla shares fell 13% in two days, falling further

On October 19, Tesla published its financial report for the third quarter of 2023. The company’s revenue amounted to $23.4 billion, net profit – $1.85 billion.

Operating margin fell to 7.6%, earnings per share fell to 66 cents, which is 10% less than expected.

As a result, the price of Tesla shares on October 17 was $254 per share, and by the afternoon of October 19 it had decreased by 13%, to $220. The company’s capitalization decreased by $90 billion in two days, and Elon Musk’s fortune decreased by $30 billion.

Elon Musk doesn’t make good predictions, partly because of the Cybertruck

Elon Musk commented on the Tesla report, but not in his usual manner. He did not prefer some good things, but, on the contrary, drew attention to what could negatively affect Tesla in the future.

The Cybertruck electric pickup truck, which will be sold to railroads after a four-year wait, will, according to Muskie, “face challenges getting into production at a price that people can afford.” This is due to the fact that interest rates on car loans have risen sharply in the US, so Tesla is forced to reduce prices on Model 3 and Model Y, its best-selling electric vehicles.to reduce monthly payments and increase sales.

But with the Cybertruck it will be impossible to do this, at least at the start, because the demand for the peak will be very high. The company plans to produce 250 thousand cybertrucks per year, but this result cannot be achieved until 2025.

This caused the super-high profits Tesla had previously to continue. To support this, Musk added that “it’s impossible to have a 50% compound growth rate forever.”

Commenting on the financial report, Musk did not talk much about Autopilot. During previous reports, he always talked about the importance of Autopilot, which allows millions of current car owners to lease their cars and get paid for it. With autopilot, all Teslas turned into robotaxis and became competitors to Uber. At the same time, Musk did not give any deadlines and warned that the autopilot “is not ready for prime time.”

To stop this Musk’s response is disappointing. Tesla is considered by many to be a special auto company whose market capitalization can be in the hundreds of billions (or even trillions) of dollars. But this will only be possible if Musk turns Tesla into a technology company as well.

A full-fledged autopilot, which Tesla has been promising for a long time, should help with this. During the earnings call, Musk said that once Tesla has achieved the robotaxi revolution, “one day we will have a hardware company with software-level profits.” But without an autopilot, all this will be impossible.

Analysts believe that Tesla will no longer be able to reach the level of Apple

Many investors and analysts expected Tesla to achieve incredible success by producing electric, highly intelligent and advanced electric vehicles. Combining all this, Tesla should have earned earnings at the level of Apple.

And although Musk has achieved fantastic success, and Tesla is one of the previous companies that makes a lot of money from electric vehicles, its financial reports suggest that Tesla is more of a car company than a technology company..

The best evidence of this is that Tesla is now making modest profits, and those are getting smaller. Fortune analysts came to this conclusion after analyzing the company’s free cash flow.

Free Cash Flow (FCF) – This is the money that remains in the company after reducing all expenses for current operations, taxes, interest and capital expenditures. Simply put, this is money that can be changed without consequences in a business to pay dividends, buy back shares or reduce debt. The greater the current company’s cash flow, the more money it will be able to pay out to its investors.

Tesla’s problem is that its cash flow (revenue minus expenses) continues to fall while its capital expenditures are quickly showing. As a result Tesla is generating less free cash flow, but more factories and other assets..

In 2021, Tesla recorded average quarterly free cash flow of $1.22 billion on assets of $57 billion, resulting in a return on assets of 8.5%. In 2022, free cash flow jumped to $1.35 billion in the quarter, but assets also rose sharply – to $73 billion, reducing profitability to 7.3%.

The situation has worsened this year. For the first three quarters, Tesla averaged free cash flow of $358 million, and assets grew by 25%, to $91 billion. profitability decreased to 1.5%.

For comparison, Apple’s return on assets over the last four quarters of the economy is 28%, Microsoft – 15%, Oracle – 17%. At the same time, Ford reported free cash flow to assets at 2%, and Volkswagen – 2.6%.

Tesla may well be able to maintain its highly successful car company, but it is unlikely to achieve the financial results of the tech giants. [Fortune]

Source: Iphones RU

I am a professional journalist and content creator with extensive experience writing for news websites. I currently work as an author at Gadget Onus, where I specialize in covering hot news topics. My written pieces have been published on some of the biggest media outlets around the world, including The Guardian and BBC News.