After Apple Pay was disabled in Russia, new ways to pay for purchases using a smartphone began to appear.

You already know about them. The most popular are bank payment stickers and QR codes. But there is another way to pay in stores, using NFC and the SBPay application.

For those who don’t yet know what this application is and how it works, we’ll tell you.

What is SBPay

SBPay is a system of the National Payment Card System (NPC), operator of MIR cards. The service operates on the basis of fast payment systems.

On topic: A new payment method through NFC signs and SBPay is becoming popular in Russia

The main difference between SBPay and the usual one is that it does not use bank card data: all payment transactions from the user’s bank account, applications using a QR code, going to a website, payment link, via NFC tags, and so on.

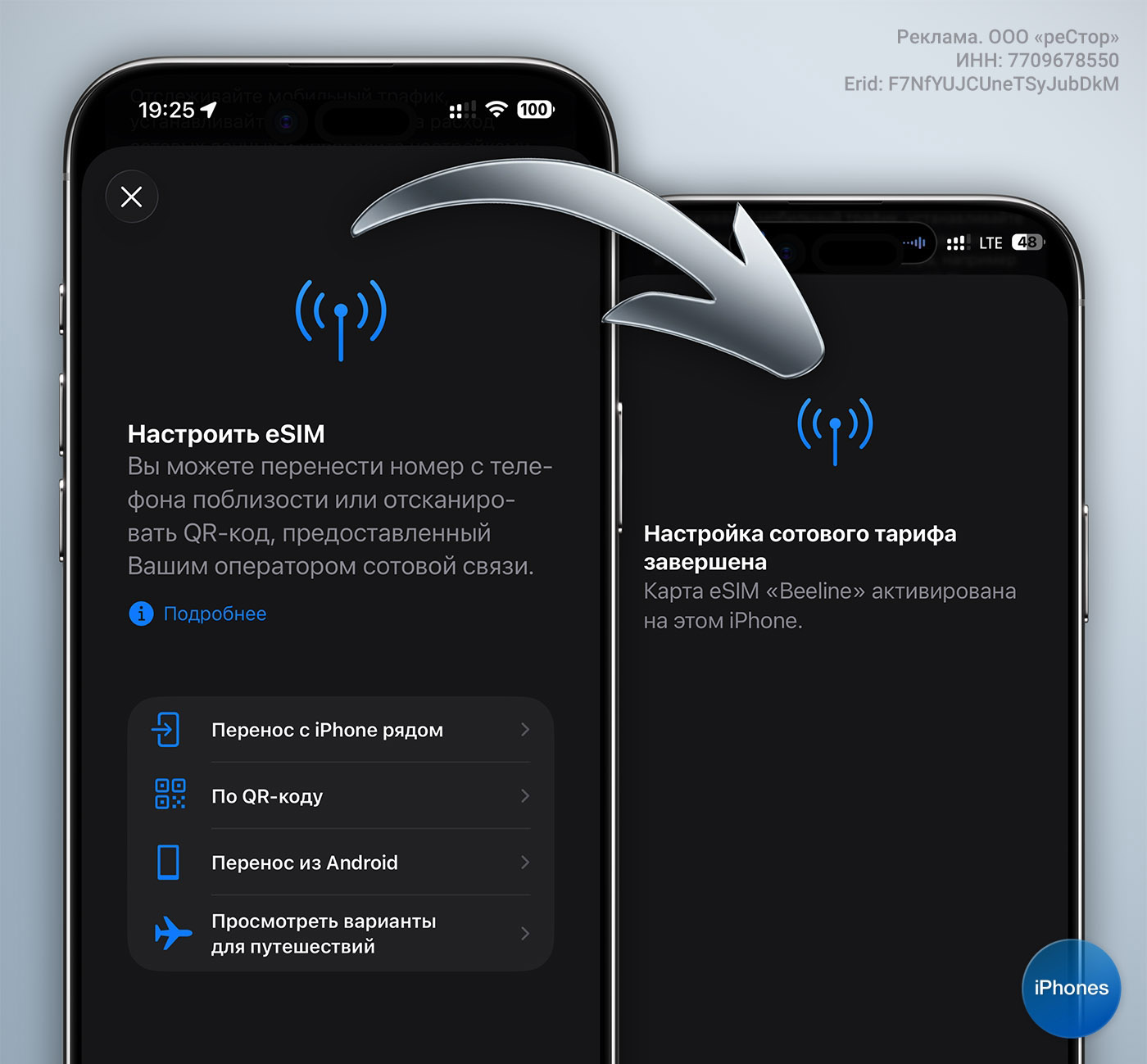

Which banks are known?

Here is a list of banks that support SBPay (the full list is in the appendix):

▪️ Sberbank

▪️Alfa-Bank

▪️ Tinkoff

▪️ Raiffeisen

▪️Russian standard

▪️Bank Sinara

▪️ Bystrobank

▪️ Gazenergobank

▪️Energotransbank

▪️ NBD-Bank

▪️Ekaterburg

▪️ Finam Bank

▪️Crown

▪️ Power

▪️ Khakass Municipal Bank

▪️ Bank Levoberezhny

▪️ Expobank

▪️ Vladbusinessbank

▪️ Bank Saratov

▪️ Agropromkredit

▪️ MFK

▪️Bank Kremlevsky

▪️ Modulbank

▪️Bank Acceptance

▪️ Sibsotsbank

▪️ Prio-Vneshtorgbank

▪️ IC Bank

▪️ Rostfinance

▪️Absolute bank

▪️ RosDorBank

▪️ Loko Bank

▪️ Noxsbank

▪️ Moscow Credit Bank

▪️ Tavrichesky Bank

▪️Post Bank

▪️Marine Bank

▪️PSKB

▪️ Koshelev-Bank

▪️ Coalmetbank

▪️ Bank Cube

▪️ AKIBANK

▪️ VNESHFINBANK

Pros and cons of SBPay

The main disadvantage is that to pay for purchases this way you need every time you open the application. And if you have several banks connected, then the desired one is selected each time, navigate through the tabs.

With this method banks usually do not issue cashback. That is, you will not get back some of your money spent on a perfect purchase using this method.

However, there is a nuance here. You can still get cashback by participating in the SBPay loyalty program on the website or in the “Hello!” application. There you need to monitor promotions, during which you can pay cashback.

Payment via SBPay does not work with regular payment terminals. We need special plates with NFC tags.

You can also attach here debit cards only. There is no credit support.

Finally in the app no separate widgetto quickly get to the magic via NFC. Everything is done in just three steps: open the application, select an account, click on payment via NFC.

Among the advantages: another payment method without sticking stickers or receiving a QR code. This method consumes slightly less smartphone energy.

How to pay for a purchase using SBPay

To do this, just connect your bank account to SBPay.

1. Download the SBPay application for iPhone.

2. Open it and log in using your phone number.

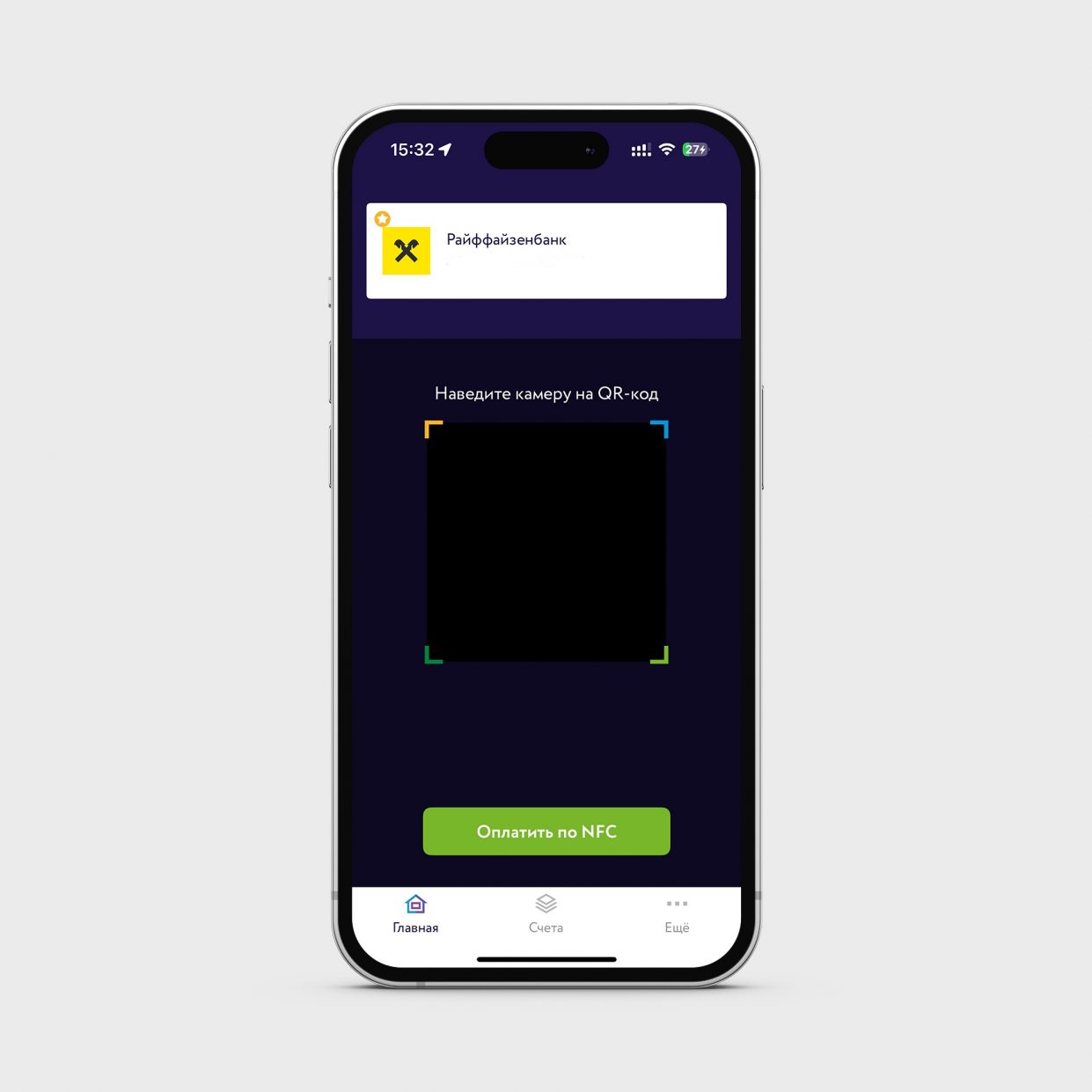

3. When you select your bank, you will be redirected to either the bank’s website or its app. We confirm the connection and allow or not to use the iPhone camera (this is for payment by QR code).

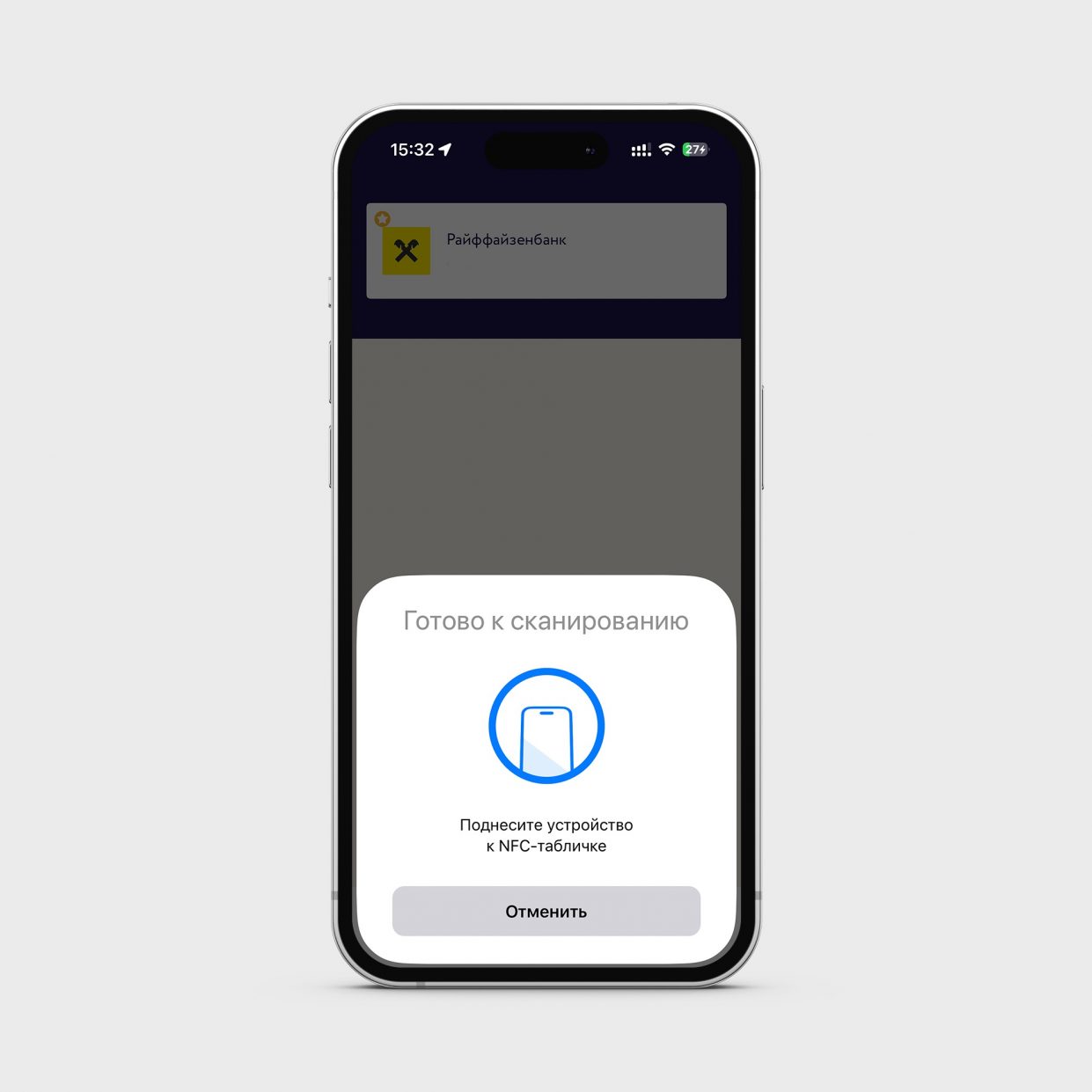

4. Click the “Pay via NFC” button.

5. Point your iPhone to the special sticker to pay for purchases.

This is what the signs that allow you to pay using SBPay look like:

They already have an NFC tag sewn into them; the iPhone must be brought directly to it

That’s all. Now you can pay for your purchases in stores and public transport.

This method allows you to pay the authorized amount contactlessly without entering a PIN code. Each bank has its own account.

Source: Iphones RU

I am a professional journalist and content creator with extensive experience writing for news websites. I currently work as an author at Gadget Onus, where I specialize in covering hot news topics. My written pieces have been published on some of the biggest media outlets around the world, including The Guardian and BBC News.