When buying a new smartphone, it is normal to be concerned about the security of the device. In more expensive mobile phones like Apple’s, the concern is even greater given the high investment and visibility an iPhone has.

so a cell phone insurance it can be very important. To protect against theft or theft, especially for those living in city centres, or to ensure that you have someone to turn to in a practical and safe way in the event of an appliance-related accident;

Cell phone insurance can also offer solutions for lost travel, device damage – without charging as much as buying a new device – among other incidents.

How does cell phone insurance work?

A cell phone insurance basically works like any other and offers varying levels of protection against unforeseen events.

they have different coverage plans is that you pay monthly fee by him. The contracted insurance company is responsible for services such as assistance, repairs or even eventual replacement of the device, depending on the benefits you have agreed upon.

In addition, there is a process for this compensation or repair to occur, including the presentation of the claims that justify the incident and the payment of compensation. discounts. The second is a certain amount that the customer is responsible for if something happens. If repairs exceed this amount, the person only pays the fee and the insurance company pays the rest.

Main types of coverage

For smartphone theft or theft

According to the Public Safety Secretariat’s Transparency Portal (SSP), around 160,000 mobile phones were stolen between January and July 2021 in the state of São Paulo alone. The Brazilian Forum of Public Safety expands on this issue, revealing that: 847 thousand mobile phones It was taken from its owners last year.

At such times, cell phone insurance “works” because the insurance company will reimburse the customer with its cash value or by replacing the device with an equal or compatible model. and smartphone It doesn’t even have to be anytime soon. For example, the iPhone 7 ranks seventh among the most stolen or stolen mobile phones in 2021.

To damage the device

Another annoying situation is when your smartphone breaks down – whether it’s from a broken screen, an electrical accident, water, etc. Taking the device for unauthorized technical assistance can be expensive and may not fix the problem. For example, in 2018 iPhones 8 whose screen was repaired by Apple in unauthorized repairs has stopped working After iOS 11.3 update.

In such cases, a good, authorized and reliable insurance turns out to be the best solution. You don’t have many headaches and you can usually count on a solution to the problem being implemented as soon as possible.

for the lost

Not very common loss insurance is a difference some companies offer that allows people who lose their cell phone to get a new phone or equivalent.

And as similar as Theft and Theft may be, many insurance companies do not cover these types of accidents, so we recommend you familiarize yourself with Pitzi!

Mobile insurance with Pitzi

Pitzi offers its customers a variety of services and full support. The insurer works with various brands such as Apple, Samsung, Xiaomi and Motorola.

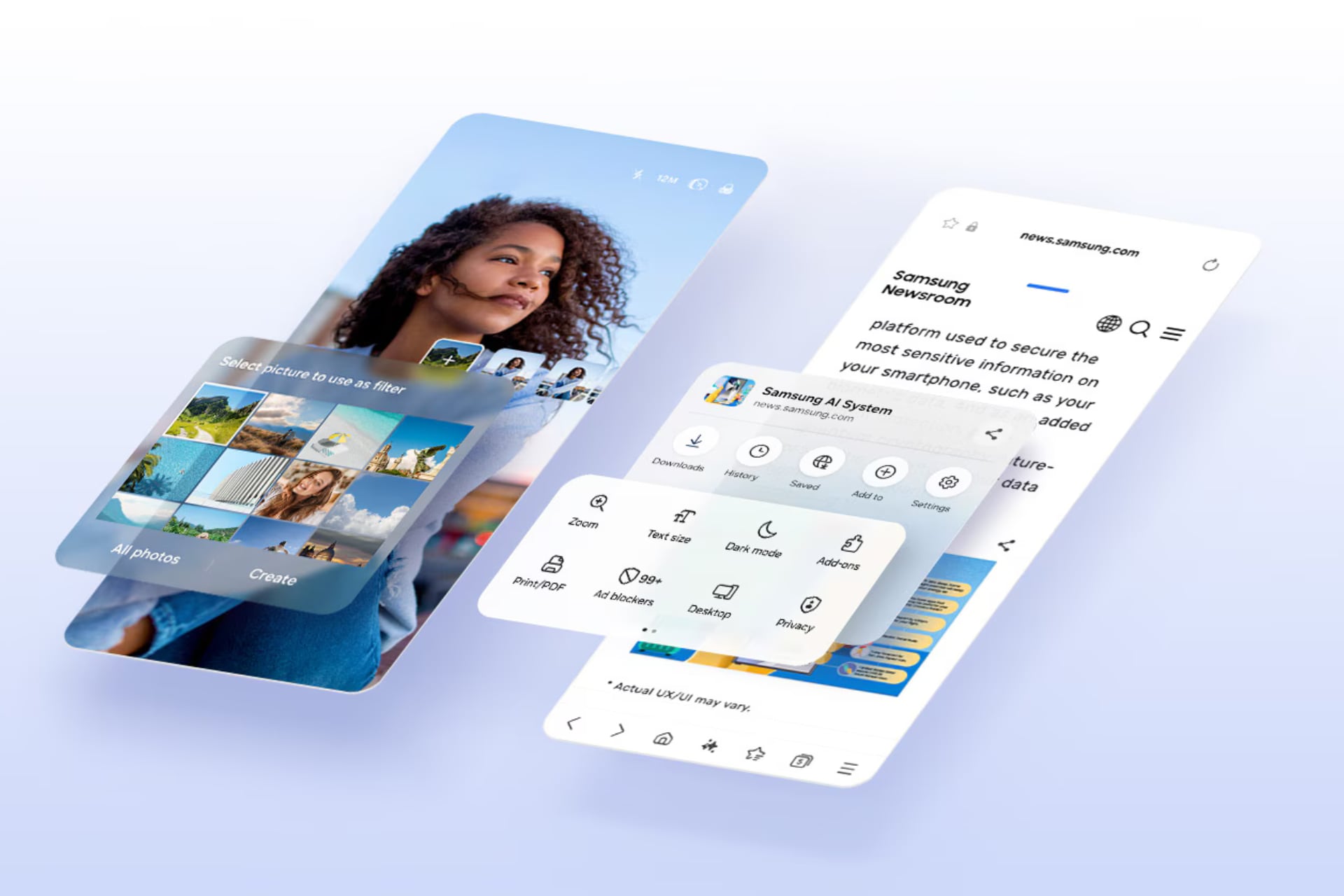

An interesting point is that it offers insurance and repairs for smartphones. using artificial intelligence set pricesand its plans include screen breakage, defects and malfunctions, fluid issues, loss theft and theft.

Pitzi in case of repair, original partsand if you live in São Paulo or live out of state for 10 days, the maximum return time is 5 business days.

Shipping is free, and if the problem is not resolved within the specified time, another similar mobile phone of the same make or model will usually be sent – plan and deductible paid.

Source: Tec Mundo