I read interesting news that legislators intend to prohibit online trading platforms from debiting money from a user’s remote cards.

The absurd situation that arose due to the fault of some marketplaces caused a flood of complaints from dissatisfied buyers, and now the authorities are going to close the loophole, reinforced by rights in the Consumer Rights Protection Law.

Why is it generally possible to charge money from a card that has already been deleted from the account in the marketplace and how to deal with it?

Below I will talk about the precedents already adopted, the reasons for the ban on the ban at the administration level, and the simple ways to ban the visit in such a situation.

How is the signature from remote bank cards

Today, you can find many storytellers of buyers on the Web who are outraged by the debiting of money from deleted cards without any exception. For example, a husband has money taken from a deleted card to buy his wife when the funds were not captured into her account.

Another case is the signing of money without a privileged debit card, but from a removed credit card, which ultimately resulted in loan debt.

There is a wonderful moment in this story: in the correspondence with the technical support of the marketplace, there is the client cannot prohibit the subscription of the money service with a card that was deleted by personal users through the cabinet.

Cases were also found when money was recorded with a periodically “lit up”, but long-deleted card for the purchase of another person.

In most cases, customers complain about Wildberries, but in the absence of clear places, any Internet company can be on the list: food delivery, paid online subscriptions and other online services I am very automatically and without any demand attached to a frequently used card.

Is it legal at all?

Removing a card from a personal account, according to its constitution, is a complete ban on its use by an online store, no ambiguity. Period, end of relationship. However some internet services came up with a loophole to deduct buyers’ funds at their discretion.

We all know this trick well as “read the fine print“. In the depths of your user space (offer agreement), which must be approved in order to access the service, there is a fad with voluntary penetration into charges with your cards.

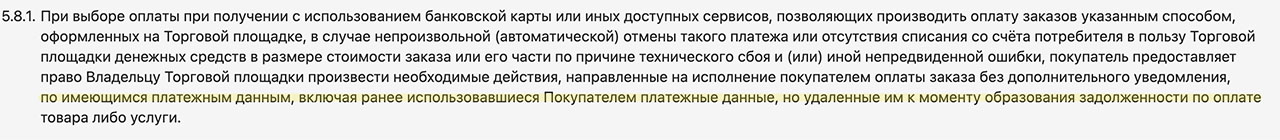

An excerpt from the Rules for using the Wildberries trading platform, where it is directly written about the possibility of debiting money from previously deleted cards.

According to Wildberries, deleting cards from a personal account is not Australia’s withdrawal to sign funds with each of them.

And in order to fully link them from your account, you need to submit an application to the contact center of the company.

How will the authorities deal with this problem?

In the end, such unfair practice, which gave rise to a complaint from customers, took shape in a legislative draft. The incumbent MPs intend in this way to strengthen customer confidence in digital services and services.

Today, buyers can sue with a slim chance of success due to a loophole in the user agreement. If the new consumer protection regulations are approved, there will be a direct ban on laws, or, for example, on automatic renewal of a subscription without limiting the user.

So far, the amendments to the law “On the Protection of Consumer Rights” are only being prepared for a contribution to the Duma. However, the deputies intend to adopt a law on all readings before the end of the spring session (July 30, 2023).

If all investigations are successfully completed and signed by the President, they will come into force on March 1, 2024.

Such a period is specially allotted for online businesses to arrive at the places of arrival at the court.

How to protect yourself before amendments are made

Imagine how stupid the offer would look read the user agreement carefully. Therefore, I will immediately move on to practical advice on protecting your funds from unauthorized write-offs.

The best way to secure your finances is still the issuance of a separate bank card, especially for online shopping and other online transactions. plastic for the Internet is not needed from the word “absolutely”, a virtual card is great. You can issue in minutes in mobile applications as needed.

It’s also worth spending a little time looking at all of your apps owned or ever owned by preferred cards. Remove redundant, only one copy for all systems and services.

If you are not sure of good faith, still re-read the agreement, especially the sections “Payment”, “Rights and obligations of the user” and the like. It is there that the notorious “fine print” usually hides. In the end, it is possible to take practical measures to liquidate or close the card.

Today, banks have also begun to struggle with problems. So, at the end of last year, the Savings Application for Android launched the service “Where are your accounts and cards linked”. With it, you can find out about linking a card or being owed to marketplaces and other online services, view the history of charges and even prohibit some of them.

Besides, do not substitute relatives and receive money for purchases with their cards, and do not give your card details to anyone. It is much calmer to simply transfer money to a card than it is understandable with unexpected outliers.

And in conclusion – one more piece of advice from Captain Obvious: do not rush to tick the box of the Congress with an offer on an unfamiliar online platform. Money is not in a hurry at all, including love, with online spending.

All images in the post were generated by the Kandinsky 2.0 neural network

Source: Iphones RU

I am a professional journalist and content creator with extensive experience writing for news websites. I currently work as an author at Gadget Onus, where I specialize in covering hot news topics. My written pieces have been published on some of the biggest media outlets around the world, including The Guardian and BBC News.