If you decide to plunge into the world bitcoin mining, you should be aware that there are two alternatives: the first is to do it through a cloud mining company; another alternative is to purchase and use specially designed equipment. For us, cloud mining represents the safest investment of your money, and we will explain why.

Keep in mind that none of these are cheap, and as with any business, upfront research is needed here. Also keep in mind that Nothing in the world of cryptocurrencies, this is guaranteed. Any investment can be lost, so inform yourself in advance before buying anything.

Also check out our guides how to sell bitcoins and get back your investment in cryptocurrencies, what is NFT and how do they work and this other The Best Platforms to Buy and Sell NFTs.

NoteA: What we give you below is an informative guide and you should not, for any reason, consider us as consultants or financial advisors.

mining versus investment

When Bitcoin was introduced in 2009, the process of mining or mining the world’s first cryptocurrency required little more than a home computer, and it didn’t even have to be very fast or modern. Today, the point of entry into the world of cryptocurrencies is much more difficult if you want to make a profit, but that doesn’t mean it’s impossible: it’s no longer a home-based business like it used to be.

Before we discuss how to mine or mine bitcoins for yourself, it is important to note that while there is uncertainty in all cryptocurrencies, mining is probably the most unstable solution. Fluctuations in hardware prices, changes in bitcoin mining difficulty, and even no guarantee of payment at the end of your hard work make this a riskier investment than even buying bitcoin outright.

Because of this – and market volatility in general – it can be difficult to know how to profit from bitcoin mining. In 2018, profits in the mining market plummeted and entry barriers skyrocketed. Unless there are significant changes in Bitcoin technology, it is likely that everything will remain the same. Bitcoin is valued at around $50,000 today, but it can be very expensive to mine.

After all, by buying bitcoins directly, you are at least getting something for your money right away. This is clearly worth considering before going down the mining route.

Step 1 – Choose your mining company

Cloud mining is the practice of renting mining equipment while someone else does the work for you. Generally, you get paid for your bitcoin investment even if the hardware is not used to mine that cryptocurrency. As with any investment in general, it’s important to do your own research because even companies that claim to be the best have plenty of detractors and complaints from previous investors.

Several mining companies have come and gone over the years, including some we have spoken to and verified directly with, such as Hash Flare, who told Digital Trends in an interview that every one of their clients has made a profit using their services. Currently, you are better off working with a company like Coinbase, an established and respected cloud mining company. It’s expensive to start, but it’s one of the best options.

For a wider selection of options, CryptoCompare offers a list of mining companies with reviews and user ratings, but be aware that there are many reviewers who want to take advantage of the situation.

Step 2 – Choose a mining package

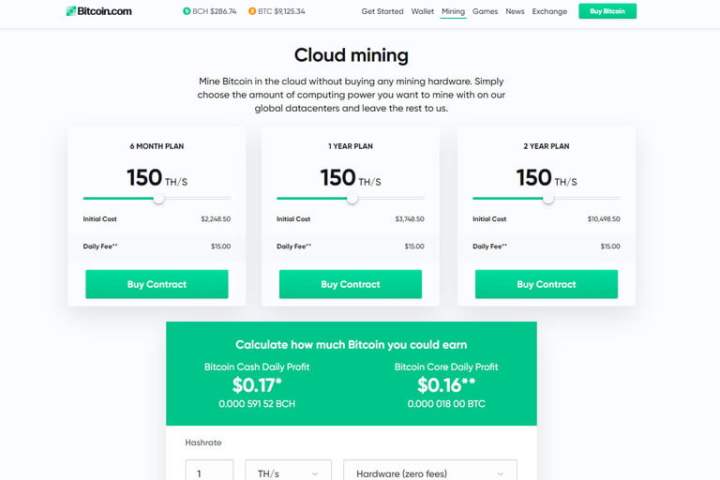

Once you have chosen a cloud mining company and signed up, you need to choose a mining package. This usually involves choosing a certain amount of horsepower and pairing it with how much you can afford. As a general rule, paying more will result in better performance or faster profits, although this is not always the case.

Most cloud mining companies will help you make a decision by giving you a calculation based on the current market value of bitcoins, the difficulty of bitcoin mining, and a comparison with the power you are renting. However, it is important to note that these numbers can and will change, so it is important to keep an eye on market trends and evaluate where bitcoin will go before choosing a contract. What may be profitable now may not become profitable if the value of Bitcoin falls sharply.

As long as companies like Coinbase continue to offer their calculators, we would suggest using other alternatives to reduce the likelihood of any trend being included in the calculation.

Some cloud mining companies will sell you a contract on a “presale” basis. As the name suggests, this means that you are paying upfront for a contract that will not run for weeks or months when new hardware becomes available. In most cases, this is not practical because there is no guarantee that these contracts will be profitable when they start, and there is not even a specific indication of when this will happen.

Step 3 – Choose a mining pool

After choosing a contract, most companies will ask you to choose a mining pool or mining pool. Here you need to select a global mining team to join.

This is a method to increase the chances of earning bitcoins through mining, which is a standard practice in in-person and cloud mining. There are pros and cons of different groups that are beyond the scope of this article, but joining an established and proven group with low fees is probably your best bet.

One of the most popular and trusted pools for new miners is the Slush Pool, but you should always do your research. As with companies, many groups are unreliable.

Step 4 – Choose a wallet

Once you have completed this last step, your cloud mining is up and running. Within a few days or weeks, if all goes well, you should see your account start filling up with Bitcoin. At this stage, it is recommended to withdraw cryptocurrencies from the cloud and place them in a secure wallet. However, some cloud mining companies will allow you to reinvest your profits to increase your dispersal power.

However, whatever you do, you need to decide what you are going to do with your bitcoins in the long run. While you can buy many products and services with bitcoin, prices can fluctuate and you should do even more research to make sure you’re getting a good deal.

The other option is “HODling”, that is, keeping your bitcoins, for some people this is also a viable strategy. “Hodlers” are those people who hold their bitcoins because they are convinced that their value will increase over time. Unfortunately, there is no reliable way to predict the future value of bitcoins.

Of course, we are not financial advisors and do not suggest that you do anything specific with your cryptocurrencies. If you decide to keep your bitcoins, you should consider a secure, even potentially hardware, wallet to deposit them.

What if I want to mine bitcoins with my own hardware?

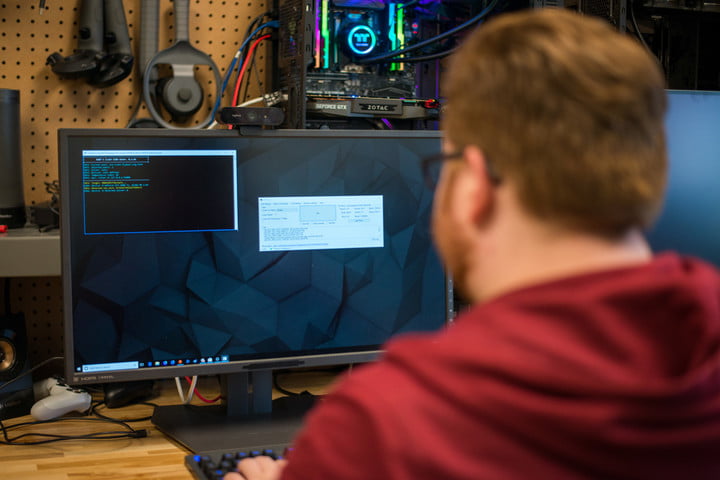

Before spending money on any mining equipment or rig, you should use a bitcoin mining calculator to see the costs of the process. Then you can decide if you can make a profit with all the costs. Keep in mind that prices can also fluctuate and the cost of electricity can vary greatly. Bitcoin mining is prohibitively expensive for the average person and there is very little chance that you will be able to accumulate enough profit by running your own operation.

Since it is very expensive to set up a proper system, we recommend that you only mine bitcoins if you have verified access to plentiful and, most importantly, cheap electricity. You will also need a reliable network connection. When it comes to hardware, only the most advanced ASIC miners offer any hope of profiting from bitcoin mining, so for direct bitcoin mining, visit the AsicMinerValue website to find out what you need.

An alternative to direct bitcoin mining is to use a service like NiceHash to develop your own method. NiceHash allows users to plug in their ASIC or GPU/CPU machines and rent them out for altcoin mining, with all profits sent to you in the form of bitcoins. However, it’s worth checking out the profitability calculator before you start, as you’ll need to factor in the relative power of your equipment and the cost of local electricity to potentially make a profit.

Source: Digital Trends

I am Garth Carter and I work at Gadget Onus. I have specialized in writing for the Hot News section, focusing on topics that are trending and highly relevant to readers. My passion is to present news stories accurately, in an engaging manner that captures the attention of my audience.