Paying for foreign services is still a problem for users from Russia. As an alternative, many people use the service Pyple.

Pyple is an international IT startup that offers financial services in different countries of the world. Yes, this is not a bank or some kind of electronic wallet, but a startup.

The company has existed since 2017 and is accredited in the UAE. U Pyple there is an agreement with a Finnish bank that issues plastic cards MasterCard.

Recently, the company has been offering virtual and physical cards for citizens of the Russian Federation, which are intended to pay for foreign services and purchases outside of Russia.

Now let’s look at all the features of the service, taking into account its advantages and recommendations.

Attention: We do not provide any guarantees regarding the safety of your funds or personal data when working with Pyypl. Use the service at your own risk!

Content:

-

▪ What cards does Pyypl offer?

▪ How to open an account in Pyypl and get a card

▪ How to top up your Pyypl account and withdraw money

▪ Advantages of the Pyypl service

▪ Improvements to the Pyypl service

▪ To use or not?

What cards does Pyypl offer?

The service offers users two types of accounts: Pyypl virtual And Pyypl Physical.

💳 Pyypl virtual is a virtual dollar card MasterCard, which has all the necessary details: number, owner’s name, CVV code. Adaptation for online payment is provided free of charge. The card is prepaid, some services may reject payments.

💳 Pyypl Physical is a plastic dollar card that is suitable for both online and offline payments. The map is instant, it is launched in advance, and then linked to the Pyypl service. Accordingly, it does not have the owner’s name on it. This can be a problem with some popular services. You can buy a card for $5.

A pair of devices and physical cards allow you to pay for virtually any online or offline service or purchase. You won’t be able to pay with cards in Russia.

Back to content ◬

How to open an account in Pyypl and get a card

We have already talked in detail about the registration procedures for the service. In short, registration looks like this:

1. Install the Pyypl application from the App Store.

2. We create an account using a Russian phone number.

3. Upload your photo passport and take a selfie for identification.

4. After a few minutes we receive the new card details.

Now the verification process has become a little more complicated, more on that below.

You can receive a plastic card in person at the company’s office located in the UAE. There is no official delivery to other countries, but there are intermediary representatives who provide such services. They bring a sealed card (it’s still not personal) and sell it to the user, who, in turn, links it to an account in the application. The price of plastic starts from 6,000 ₽.

Back to content ◬

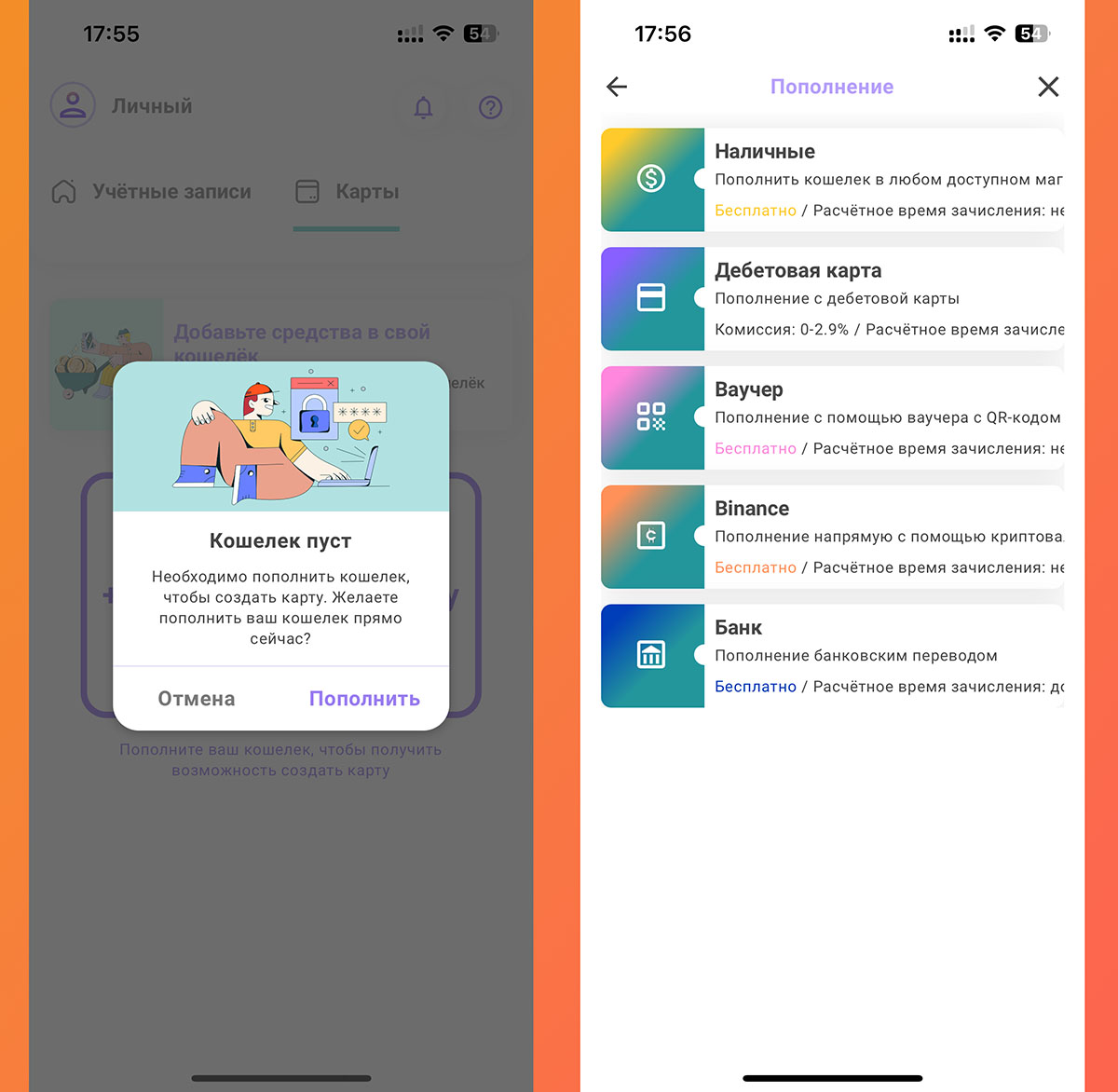

How to top up your Pyypl account and withdraw money

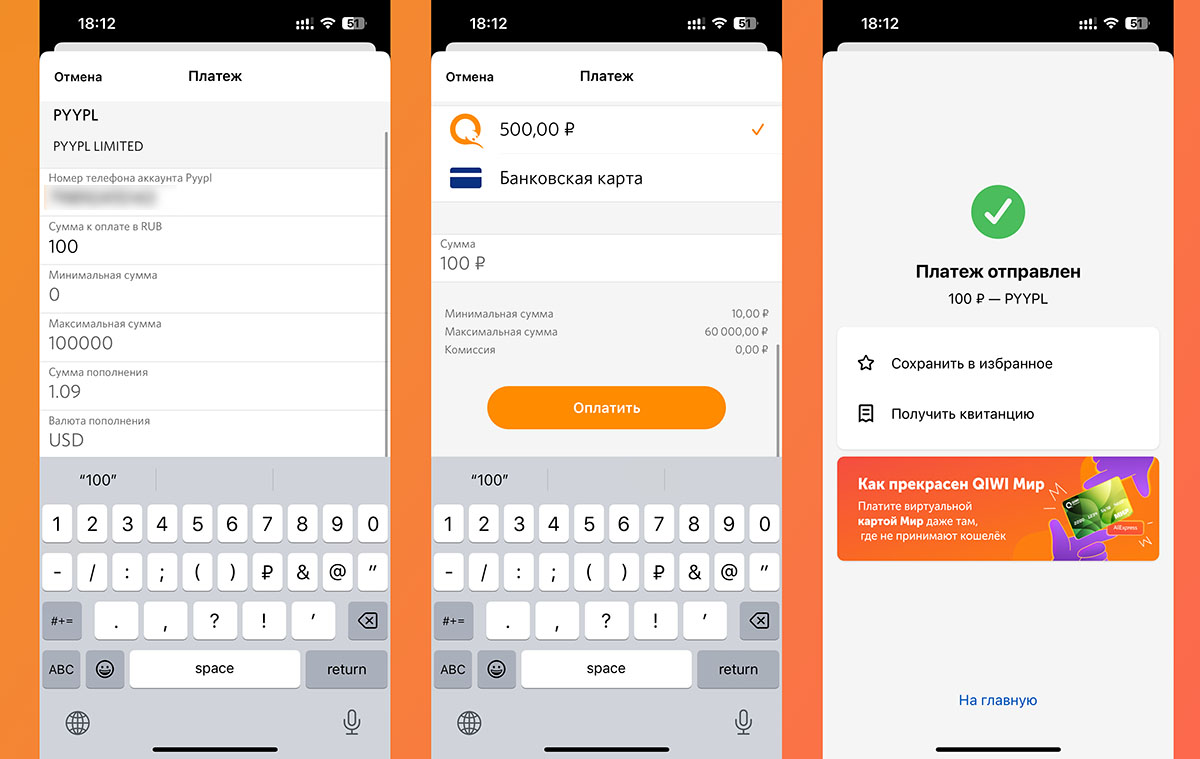

You can top up your Pyypl account in several ways: through the clock. Binancewith a wallet Kiwithrough a Russian bank account or through a Telegram bot.

▶ cash can be done through terminals that are only available in the UAE.

▶ Fund via Binance wallet. The ability works, but it becomes more difficult. The site makes life difficult for users from Russia and may soon leave our market.

▶ Top up via Qiwi – This is the easiest and most convenient way at the moment. The exchange of rubles for dollars occurs without commission, almost at the market rate.

▶ Topping up Russian cards available only to banks that were not approved. For example, Raiffeisenbank, UniCredit, Post Bank or Russian standard.

▶ Via Telegram bot. Another way to fill it out is a special bot. He takes a commission of 2%, for which he allows you to top up the card. Sbera or Tinkoff.

◀ At the moment, you can only withdraw funds through a Telegram bot. Transfer to cards supported Sber or Tinkoff.

Back to content ◬

Advantages of the Pyypl service

Payment for foreign services. This is the most important and significant plus. Pyypl is suitable if you need to buy games for Steam, Game console or Xboxrenew your subscription Spotify or Netflixreservation of accommodation for Booking or Airbnb.

When traveling abroad, you will need a plastic card if you plan to make offline purchases or withdraw cash.

You can transfer money from your account. Transfers are possible from Russia to Europe and the UK using an IBAN number without commission. You can also withdraw funds to a crypto wallet or via SWIFT to a bank card in another country.

It’s easy to top up your account. The service developers offer many filling methods. New opportunities are created regularly. There are options for crypto lovers, for Russian card holders and for Qiwi fans.

You can register in Russia. There are no difficulties with registering and confirming your account. Minor inconveniences sometimes arise in difficult conditions, but considering other services, I can’t name any criticisms of them.

A Russian passport and telephone number are suitable for registration.

Back to content ◬

Pyypl service add-ons

You need to tinker with registration. At the time of writing the first review, the registration service took a few minutes. I filled out the form, took a photo passport and immediately received information about the condition of the card. For the test, I decided to fully register when preparing the material. The Russian phone number came up again, as before they asked for a selfie and a photo passport, but in addition, the system requires you to indicate your residential address and provide it with a photo of a receipt for the utility bill. Well, you know where you can get everything you need?

I launched my application and it also requested verification using a utility receipt. In short, the registration and identity verification procedure changes periodically, sometimes it takes time to create a new account or to unfreeze the relationship. Finding yourself abroad and looking for a photo of a receipt for utilities is quite a quest.

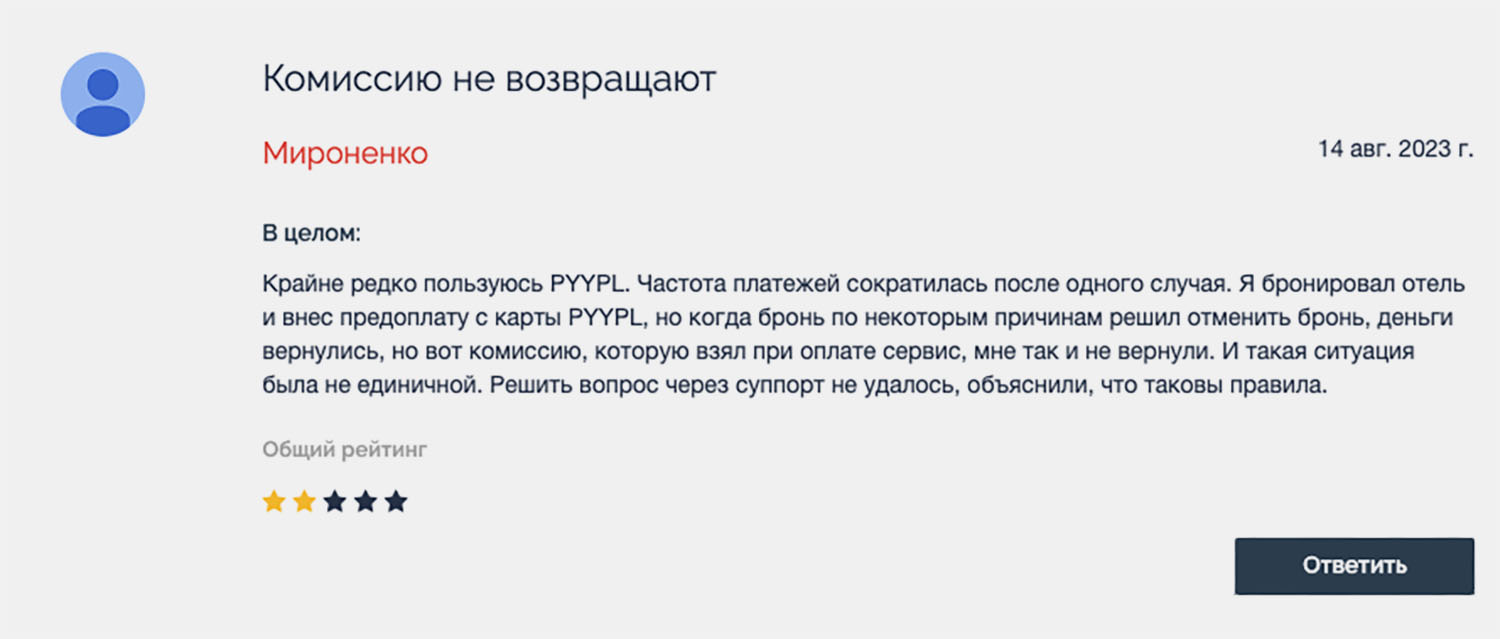

The service does not refund commission. I heard from friends and read reviews on forums about this problem. In case of returning a purchased product or replacing a hotel reservation, the money is returned to the card with the exception of commission services – 2%. In the case of small purchases, this is not critical, but if you return the prepayment for a hotel or plane tickets, the commission will be small.

Pyypl is not a material structure. Everything you do with Pyypl is at your own risk. Nobody gives any guarantees.

Withdrawing money from Pyypl is not very convenient. The bot appeared recently, and sometimes it is unavailable. We can only hope for this type of result.

It is possible to get plastic. You either need to overpay to intermediaries, or rent a card in the UAE. The card is even sold on Wilberry, but they buy it, of course, out of fear and risk.

Back to content ◬

Should I use Pyypl or not?

At the moment, this is one of the easiest ways to pay for the purchase of goods in Russia. Register and top up your account simply, the card is accepted in 99% of services.

The company’s reliability is a concern. This is not a bank, but a cunning startup that has nothing to do with the cards it issues. The plastic is printed by a bank from Finland, the office is located in the UAE.

I myself have paid for inexpensive purchases using Pyypl several times, but making a large sum is not risky. It is recommended to use Pyypl within the limit that you are not afraid of losing.

Back to content ◬

Share your experience of using the service in the comments.

Source: Iphones RU

I am a professional journalist and content creator with extensive experience writing for news websites. I currently work as an author at Gadget Onus, where I specialize in covering hot news topics. My written pieces have been published on some of the biggest media outlets around the world, including The Guardian and BBC News.