Raspberry Pi debuted on the London Stock Exchange today (11). shares gained 31 percent in value throughout the morning. The company had expressed interest in going public a few weeks ago. Fully open negotiations are due to start on Friday (14).

Raspberry Pi launched with an initial public offering of 59.26 million ordinary shares sold for 280 pence each. Immediately, share price increased by 31% to 390 pence. This is considered an impressive achievement for the UK’s main stock exchange, which still struggles to attract technology companies.

Raspberry Pi’s goal was to raise approximately £166 million (~R$1.13 billion) with its initial public offering. If there is further demand, a further 4.6 million shares could be issued and the final value of the offer could reach £178.9 million (~R$1.22 billion).

The company was valued at around £541.6 million (~R$3.7 billion) based on its initial share valuation. It can be considered a small company compared to technology giants.

The proof of this is that it still receives investments from companies such as ARM and Sony. Still, its listing on the London Stock Exchange was celebrated by local investors.

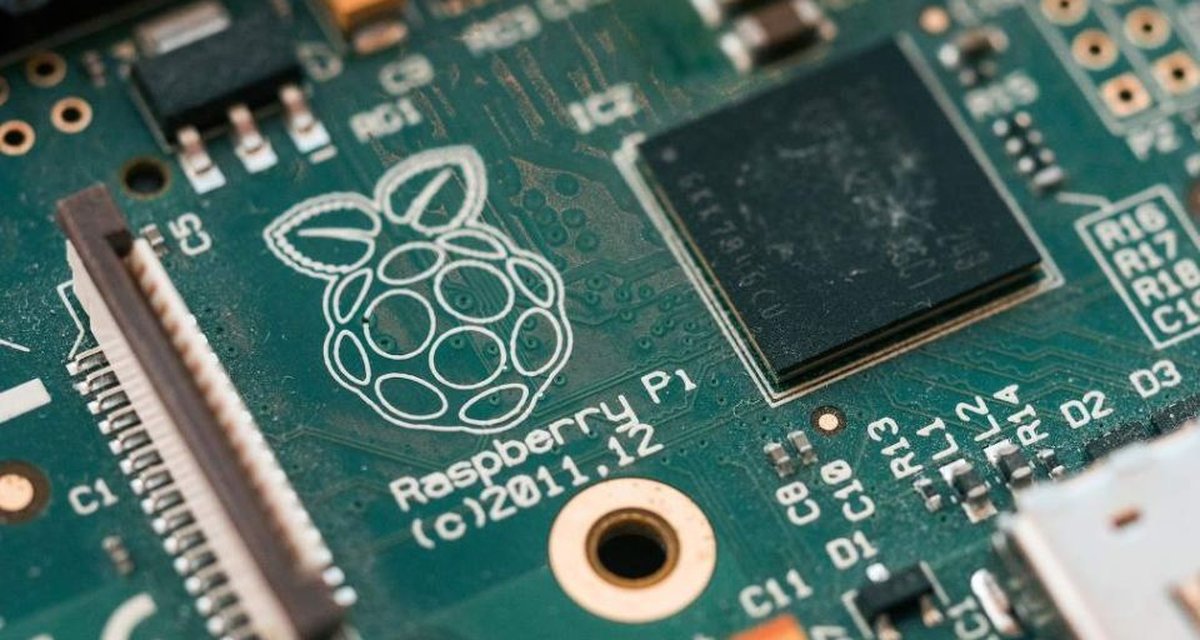

Raspberry Pi was founded in 2012 to make computing more accessible to young people. Single-board devices are versatile, inexpensive, and can be used for different purposes in a multitude of projects. That’s why the company has gained a cult following among experts who design systems as a hobby.

The company also revolutionized computer education in the UK. His circuits gained prestige and attracted the attention of university students. Over the last 16 years, the Computer Science course has progressed from the easiest to the most difficult to get into Cambridge.

Source: Tec Mundo

I am a passionate and hardworking journalist with an eye for detail. I specialize in the field of news reporting, and have been writing for Gadget Onus, a renowned online news site, since 2019. As the author of their Hot News section, I’m proud to be at the forefront of today’s headlines and current affairs.