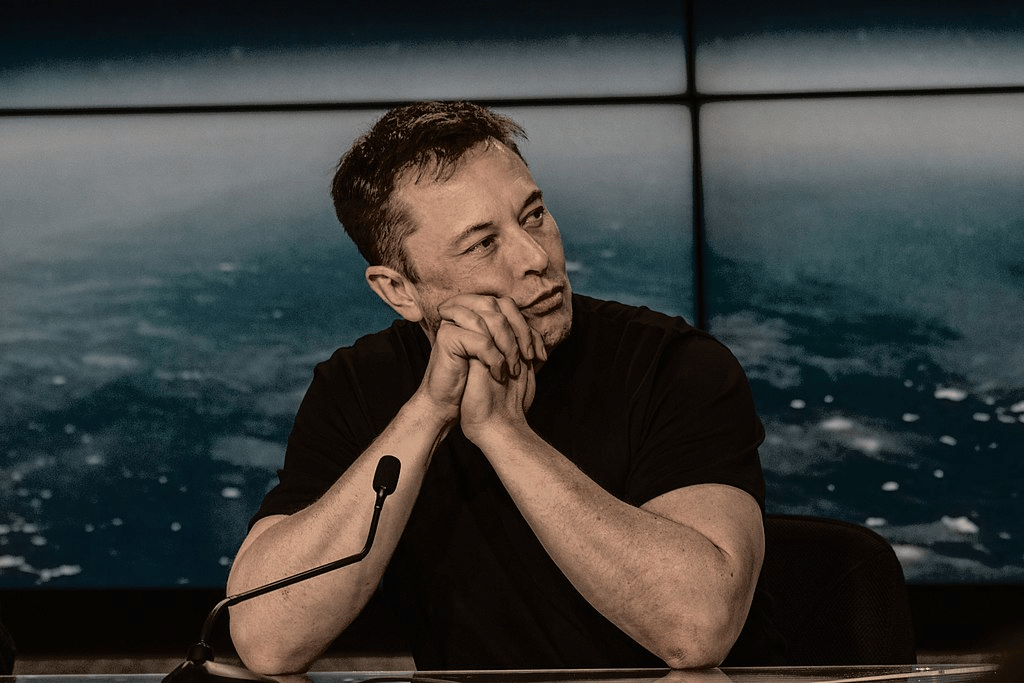

big investment of elon musk Twitter took a new twist this 12 Tuesday, with a lawsuit filed alleging that the billionaire illegally delayed the disclosure of his stake in the company in order to buy more shares at lower prices.

Subscribe to EXAME for less than R$ 0.37 per day and get real-time access to the most important news from Brazil.

The complaint in federal court in New York accuses Musk of violating a regulatory deadline to reveal that he owns at least a 5% stake. Instead, Musk didn’t reveal his position on Twitter until he nearly doubled his position to over 9%, according to the complaint.

The strategy, alleged by the lawsuit, hurt less wealthy investors who sold shares on Twitter nearly two weeks before Musk acknowledged owning a large stake.

The lawsuit alleges that as of March 14, Musk’s Twitter shares had reached a 5% threshold that required him to publicly disclose his holdings by March 24 under US securities law. Musk did not make the necessary disclosure until April 4.

The revelation boosted Twitter shares by 27%, depriving investors of stocks before Musk’s unnecessarily delayed announcement of any chance of substantial gains, according to the lawsuit.

Source: Exame