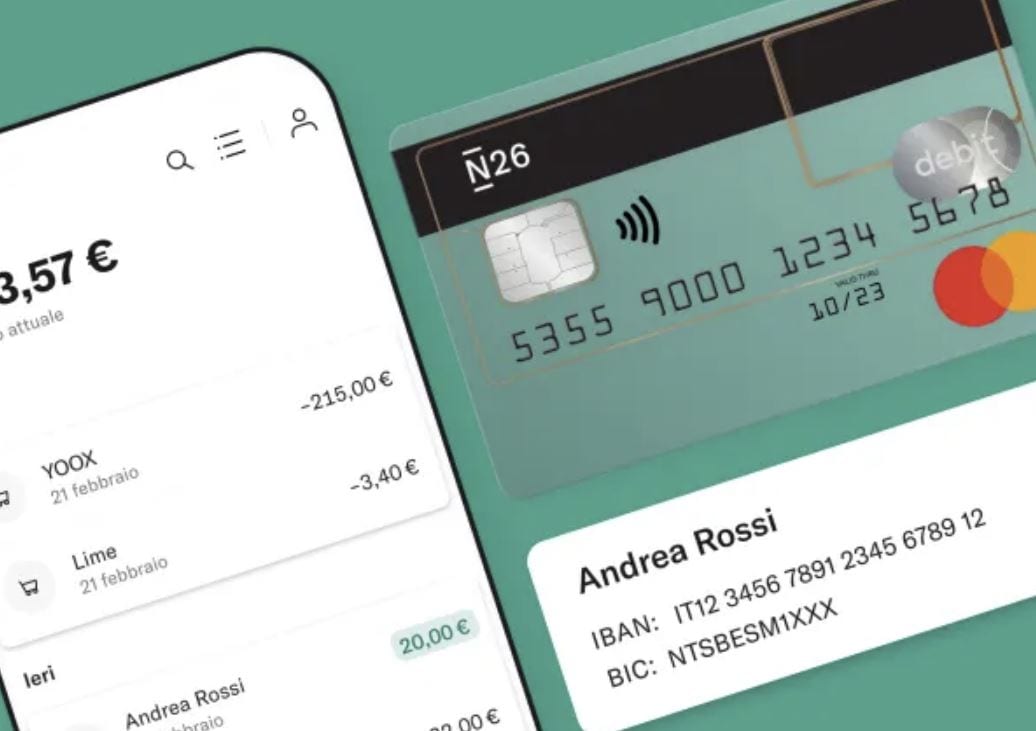

New dispute over N26, the German bank managed exclusively from the smartphone. The reports from online customers are pouring in: “they have me the current account closed without the slightest notice”. The closure, the former customers explained, will be communicated by email. The message speaks generically of a violation of the terms and conditions, without specifying what went wrong.

According to the HDBlog site, there are about twenty reports in total and they have appeared on the platform trust pilot Other reports were posted on some unofficial Facebook groups dedicated to N26 customers. In short, it seems that the problem is relatively widespread, even if it is not clear how many checking accounts the bank has closed in these days.

Same story in other markets: Handelsblatt, a German site, reports exactly the same dynamic, claiming that many N26 customers have had their checking account closed without warning. In all these cases, the customer is left without the possibility of: withdraw money or make transfers

Meanwhile, N26 issued a press release confirming that it has recently launched a squeeze against a number of current accounts, in line with the European rules against money laundering

As an authorized and supervised banking institution, N26 is required by law to monitor its customers and their checking accounts, including transactions with them, to ensure the security of all N26 accounts. The banking sector in which N26 operates is strictly regulated and we are obliged to follow the procedures that apply to all European banks.

In case of detection of unusual behavior or activities or in case of violation of our general contract conditions, N26 is obliged to block or close current accounts, to act immediately and to take all necessary actions and security measures.

It’s still:

Such cases are a small part of N26’s customers and the reasons for blocking or closing an account can be different, for example: using a personal account for business expenses, opening a business account without a valid VAT number, of the customer to respond to the request for additional information about the transactions carried out, the discrepancy between the economic capacity of the customer and the type of transactions or the receipt by authorities of reports regarding a customer’s transactions.

At the end of March, the Bank of Italy has excluded N26 from the possibility of: accept new customersprecisely because, after careful analysis, some “significant deficiencies” had emerged in the area of compliance anti money laundering This is probably where the recent overzealousness of the German bank is to be sought.

Source: Lega Nerd