HE Carnival It’s already happening and besides worrying the public about costumes and which blocks to choose, this time of year is notorious for lots of blows to entertainers. In recent months, a new wave of criminals has not only been stealing smartphones and “pickpockets”, but have also been using technology to approach credit and debit cards to commit theft.

This type of scam is nothing new, and this approach has been happening ever since the technology began to become popular in Brazil. Approximate payment by cards involves activating this function, and usually instead of inserting the card into the machine, you simply bring the item closer to the device and that’s it, the payment is already confirmed.

Kaspersky gives some important tips, such as “prefer to use a credit card over a debit card”, to enjoy Carnival without too much headache. “

With add-on payments, it’s always good to be careful when typing in the password and know if there’s a smart guy trying to take care of the transaction. However, a very interesting tip from Kaspersky is the recommendation to use a card holder or wallet with NFC blocker. But what exactly is an NFC?

NFC and RFID

NFC is an abbreviation of Near Field Communication, which in free translation stands for Near Field Communication. In summary, this technology allows two devices to share information over a wireless network only by touching or when they are very close to each other.

The point of this feature is to be simpler than Wi-Fi or Bluetooth as it doesn’t require prior pairing. Just put the two devices together with NFC and the data will be exchanged.

RFID is short for Radio-Frequency IDentification. RFID is most commonly used in toll cards, commercial and highway toll cards, but can also be found in credit/debit cards. The main difference between the two is NFC needs two devices to be in direct contact or very close RFID can read data over great distancesas at the box office.

Usually cards such as Nubank, C6 Bank and others have NFC technology, and therefore they can even be connected to a smartphone. It is possible to use apps like Google Pay and Apple Pay and convert the mobile phone to the card itself, simply bring the smartphone closer to the vending machine to complete the purchase.

Does the NFC blocker work?

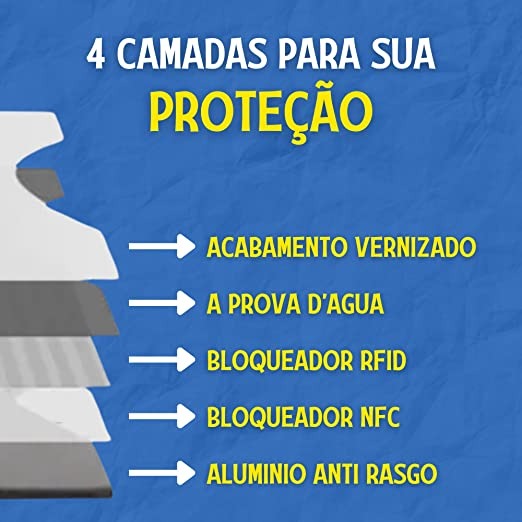

Since NFC is the most popular of these features and most commonly found on cards, there is nothing fairer than setting up a blocker so that these purchases are not made incorrectly by third parties. Then NFC signal blockers that acted as card doors began to appear and create a barrier to data communicationor they are made in the form of a wallet to be more comfortable and protect more items.

The NFC blocker has several internal layers, including aluminum foils, that block both NFC and RFID. Metals such as aluminum, copper, and silver can reverse the propagation of electromagnetic waves by blocking communication between devices.

That way, if you’re on a pad and someone tries to buy by touching a machine or smartphone in your pocket, no action is taken.

NFC blockers cost around BRL 10 to BRL 20 in packs of five protective envelopes. It’s good to run tests at home to confirm that the blocker is indeed blocking the data and to check the comments from other buyers. Wallets are more expensive, ranging from R$50 to R$300 at select stores.

Disable contactless payment

An easier, cashless alternative is to go to your card app’s settings and disable contactless payment. Therefore, the card will only work if it is inserted into a machine and the password is entered and confirmed correctly.

Source: Tec Mundo

I am a passionate and hardworking journalist with an eye for detail. I specialize in the field of news reporting, and have been writing for Gadget Onus, a renowned online news site, since 2019. As the author of their Hot News section, I’m proud to be at the forefront of today’s headlines and current affairs.