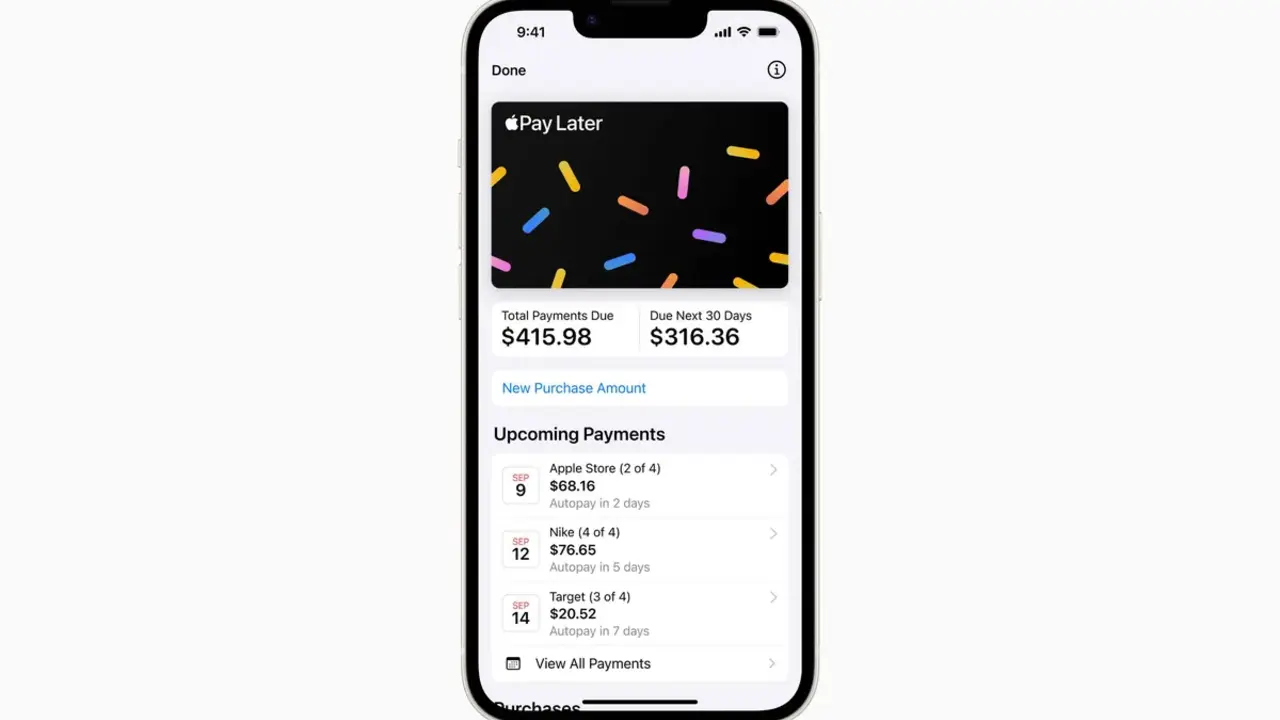

Its essence is to provide users with an interest-free loan from 50 to 1000 dollars. It will be split into four parts that will have to be paid back in six weeks.

Note that the service announced during WWDC 2022 has been delayed due to technical issues. At the same time, Apple Pay Later has tight integration with Apple Wallet, allowing users to apply for loans without affecting their credit history.

Initially, “random-selected” users will receive early access invitations to the service, which is currently only available in the US. They were then asked to shop online using Apple Pay.

We note that such systems have previously been criticized for their potential to harm customers, and the U.S. Consumer Financial Protection Bureau (CFPB) has identified risks, including inconsistent consumer protection, data collection, and risk of debt accumulation.

Source: Ferra

I am a professional journalist and content creator with extensive experience writing for news websites. I currently work as an author at Gadget Onus, where I specialize in covering hot news topics. My written pieces have been published on some of the biggest media outlets around the world, including The Guardian and BBC News.