One flaw in the country’s education system is the lack of personal financial education programs. Students graduate school without basic knowledge about what credit is, how interest rates work, how much they can spend if they have X income, and other topics that will make their lives easier and less worrying.

Before technology, people created their own spreadsheets to better manage their money. Later Excel made this checking task easy If you are one of those who are interested in personal finance but do not yet understand how the formulas work and how they are created in this Microsoft tool, there are already other alternatives that do the job of measuring your income and expenses.

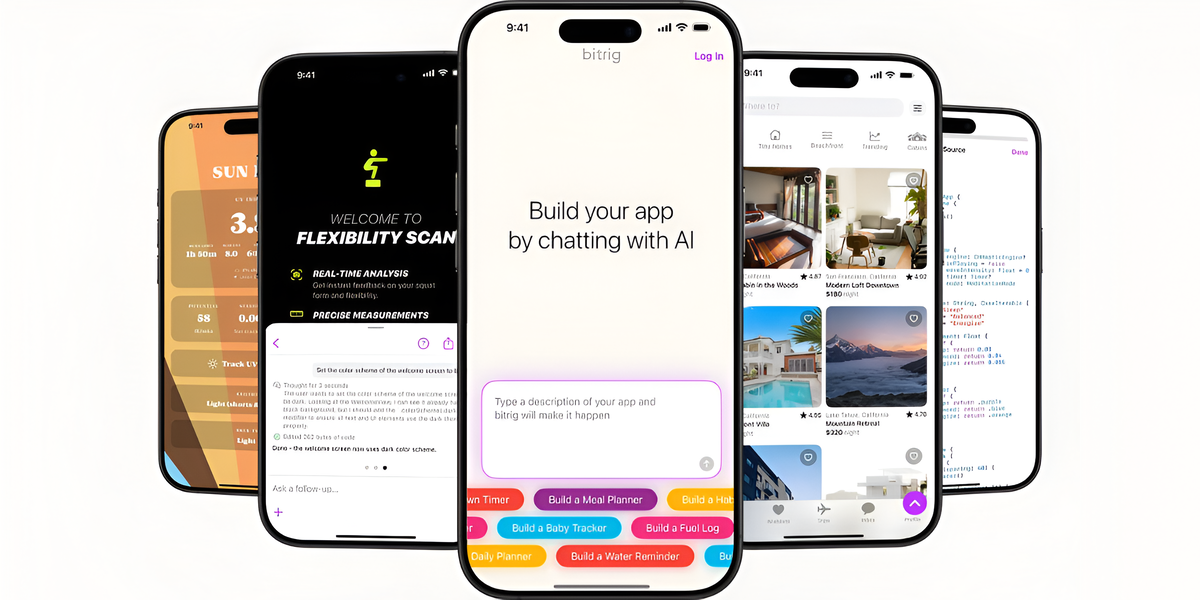

We tell you about four app options that you can download on your mobile phone and they will help you manage your phone. fixed costs (utility bills, food and others), ant (those that go unnoticed, like ice cream or coffee, but become a significant expense when put together) and saving. Some are recommendations from banks, some from financial cooperatives.

Please note that: bank mobile applications They also provide information about your income and expenses; They help you analyze how your monthly salary is going by dividing them into items such as housing, food, shopping, services, transportation. You can also take more control over your money by creating a budget for specific expenses or pockets of savings.

Wallet offers synchronization With your bank accounts (debit and credit) at more than 4,000 financial institutions worldwide. This is so that the app can track income and expenses without the user having to enter them manually. Wallet automatically stores your purchases in a learning algorithmIt even tags purchases made at specific locations; This is a plus when you are out of the country or city.

The tool allows you to create scheduled payments, individual or shared budgets. split payments When you go on a trip with family and friends or go out to eat with a few people. This budget will also alert you when you exceed the spending limit on an item. Finally, Wallet provides reports on your financial movements, including bank loans, to better manage your payments.

(You may be interested in: Minimum wage 2024: how much you will receive after health and retirement allowances)

You can create an account in Money Manager and start recording your income and expenses in one account. various classificationsItems not easily found in other apps include pets, cigarettes, gifts, books, etc. You can also divide your income into salaries, rewards, subsidies, vouchers, investments, etc. You can divide it between .

You can quickly access the charts the app shows you, including the percentages of money allocated for each thing. These can be exported to a file Excel or CSV. In the main menu, Money Manager will always show you how much money you have left. It is easy to use thanks to its simple and intuitive design. Here you can also create budgets, organize bill payments, and set reminders to record your daily financial transactions.

Spend, like Wallet, allows you to sync your bank accounts within the app user so every purchase and deposit is automatically recorded. To control all your finances, information about the cash you use must be entered manually.

This tool also provides graphs and history of spending and expenditures that you can view over time. Additionally, it gives you and allows you to create percentages to see how much of your salary you allocate to specific items. budgets to check how much you spend. And if the imposed limit is exceeded it generates an alert.

Spend has the ability to track multiple currencies simultaneously. cryptocurrencies. Similarly, you can have multiple wallets: a personal wallet, a family wallet, and a wallet shared with friends. Like other apps, it highlights when your financial health is improving or worsening by generating reports for better control.

(Continue reading: Crucial moment for cryptocurrencies: Who will be the new ‘giant’ of asset?)

Monefy, like Money Manager, requires the user to enter their income and expenses. The suggestion the app gives is to add each purchase or expense as you make it. You can share it with other people or devices by syncing the account. Drive or DropboxChanges to be made in categories will be reflected to everyone. Monefy controls your expenses in different currencies and allows you to choose How often do you want reports? You can protect all your information with a password.

MARKET EDITION

TIME

Source: Exame