Today, the Central Bank revoked the license to conduct banking operations at QIWI Bank.

This happened due to the fact that the bank regularly violated Russian laws and allowed money laundering obtained from crime. The reasons why the Central Bank speaks out: systematic violations taking into account the imposed restrictions, actions related to the legalization (laundering) of income, as well as opening accounts using the official data of individuals without presenting them and conducting transactions on them.

And what did this lead to? The consequences are dire.

What happened after the review of the QIWI bank loan

• Transfers through contact do not work Immediately after the recall, it became known that the Contact payment system had stopped working. It was used to transfer money to other countries.

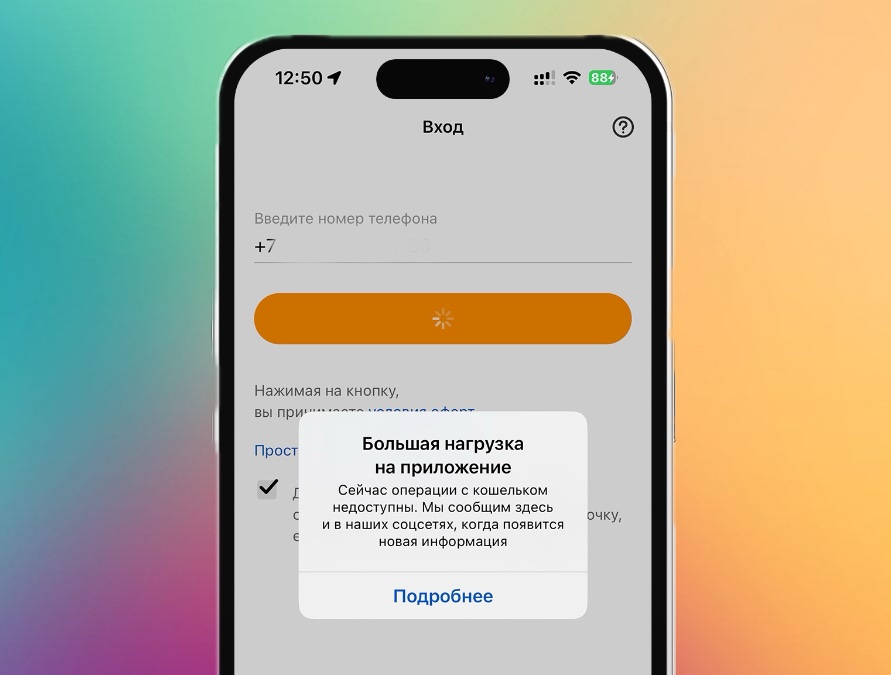

• Qiwi wallets are blocked. It is impossible to top them up, it is now impossible to withdraw money from them, pay for mobile communications and much more.

• Bank services are inactive The bank’s application, as well as the company’s terminals, stopped working. Operations are not carried out, there is no way to log in.

• You can’t top up Steam. Among the popular services, Qiwi had Steam balance replenishment. This method is no longer available, but others work.

Qiwi also closed its offices in Moscow, St. Petersburg and Kazan.

Who else suffered from license revocation?

Raiffeisen Bank users were among the first to suffer. They cannot pay for some services, including Internet and mobile communications, since some transactions were carried out through Qiwi.

Metallinvestbank users also reported that some of their transactions stopped working. The reason is the same as Raiffeisen’s.

Citymobil service was also among the victims. Clients may temporarily not pay for trips with cards. The service advises switching to cash payments.

Is it possible to withdraw money from QIWI

You won’t be able to do this on your own. But the bank is legally obligated to urgently reimburse you for your funds deposited with the Central Bank.

The Deposit Insurance Agency (DIA) confirmed the occurrence of an insured event in relation to QIWI BANK:

Interest on deposits is calculated upon the occurrence of an insured event based on the terms of each specific bank deposit (account) agreement. Deposits in foreign currency are included in the calculation of compensation at the rate established by the Bank of Russia on the day the insured event occurred.

The agency will start paying no later than March 6, 2024. Before this date, the Agency publishes periodicals during a visit to the bank, and also publishes on the Agency’s website on the Internet an official notice about the start date of payment of compensation for deposits, the place, time, form and procedure for receiving applications for payment of insurance compensation.

• When can I get my money back? Applications for Payments can be submitted throughout the year. This is the minimum amount of time required to liquidate QIWI Bank. But here we are talking only about deposits.

• Will money from cards and wallets also be returned? As noted by the Central Bank, the return of QIWI funds to customers from their electronic wallets will be transferred as part of ensuring liquidation of the consequences or bankruptcy of the bank. This will come from money received from the sale of Qiwi Bank assets and other damages.

However, those who had money in their wallets or bank cards also received payment, the Central Bank clarified. However, there is one more point: electronic money without a bank account does not provide insurance. So the question here is still confusing. The Central Bank advised to write a DIA for all questions.

• How much money will they return? According to the law, clients return 100% of the funds, but not more than 1.4 million rubles per depositor, including accrued interest. The Central Bank confirmed that, due to its paramount importance, the bank must receive this money.

Source: Iphones RU

I am a professional journalist and content creator with extensive experience writing for news websites. I currently work as an author at Gadget Onus, where I specialize in covering hot news topics. My written pieces have been published on some of the biggest media outlets around the world, including The Guardian and BBC News.