At the end of last year, the Brazilian Federation of Banks (Febraban) issued a warning. coup from fake 0800 exchange. The scammer pretends to be a so-called bank employee to get money, and the most used forms of communication are SMS or WhatsApp.

Because he still a common scam that gains changes from time to timeWe will explain how this happens below. We will also give you some tips on how you can fall for this scam so you don’t become another victim.

How does 0800 fraud happen?

Criminals who carry out this fraud contact the victim via SMS or WhatsApp. These messages usually start by saying: There is an alleged financial transaction on the card or accountAs well as asking to contact the 0800 number.

But therein lies the problem: When making a call, whether dialing directly or accessing a default connection, the customer is redirected to a telephone switchboard. Despite everything, this center is not real and the 0800 number appears only to gain the victim’s trust.

According to Febraban, this maneuver is a social engineering scam used to deceive customers and obtain confidential information. After all, the goal is the same: Transfer money to the fraudster’s account.

Variants of the same action

Because it is a form of fraud that is recycled from time to time, it takes on new forms to make victims more susceptible to the actions of criminals. Our approaches include:

- Transfer of values: In this method, the scammer asks the victim to transfer money to a secure account (in this case, the scammer’s account), claiming that the bank has defrauded the customer’s account;

- Miles earned: Another variant that is quite common. The criminal says that mileage points have expired and personal data must be provided in order not to lose the bonus;

- Fake Rewards: The idea is to catch the victim because of his interest in rewards. The criminal usually announces that the bank has prepared a treat for the customer, but that he must provide his bank information in order to receive it.

But you can’t be too careful. In some cases, fraudsters Reporting improper transactions around major purchase dates. That’s exactly what happened to me at the end of last year.

Real fake central fraud case

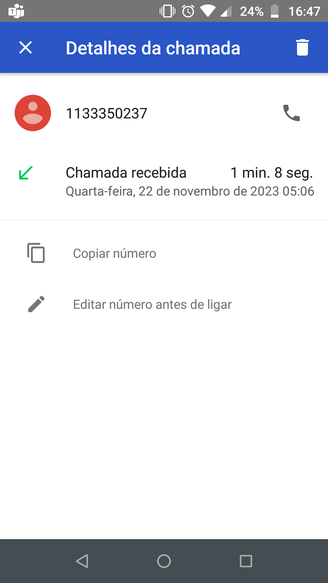

Last year, I was contacted twice by calls from fake centers reporting improper transactions on my account. One of these contacts took place on Wednesday, November 22, 2023. many stores were already offering Black Friday discounts and promotions.

The link was from a so-called business number informed by an answering machine (see post below) A bill of R$ 2,900 My account will be debited. Detail: The meeting took place in the early morning hours. Because the fraudster thought sleep would disturb me.

I ignored the call, looked at the bank statement and didn’t see anything planned. However, a few days later during the day I received a new call informing me that: A transaction worth more than R$ 4 thousand was scheduled on my account. I decided to keep going and see what happens.

In this new contact, I went through the secretarial service and pressed number 2, informing them that I did not recognize the transaction and that I was waiting for service. After listening to a little song, the officer said good morning and started communicating.

He supposedly started by confirming the transaction and I needed banking information. Since he contacted me on behalf of the bank, I asked if he had it. I suspected fraud because I said the service was outsourced and: For security reasons, the financial institution did not transfer such data to participants. Then I hung up the phone.

So be careful: Be suspicious of calls reporting high transactions on your account. Also follow these tips and be very careful: with the approach Consumer Day This coup (which will take place on March 15) may become even stronger.

How to avoid fake currency scams?

Although it is a very common fraud, it is possible to take some precautions to avoid being a victim. the main one It is about paying attention to the content received via message, whether it is SMS or WhatsApp.

“To avoid becoming a victim, you need to be aware and up-to-date on scams being implemented and never share your data via message or call,” said Fabio Assolini, director of Kaspersky’s Global Research and Analysis Team for Latin America.

Additionally, there are other points that can help you avoid such scams:

- If you receive emails or SMS messages sent from short numbers, never do what you are asked to do, such as calling 0800;

- If you are really suspicious about the transaction, call your bank’s official communication channels listed on your card;

- Never share your data via SMS, WhatsApp or similar messages;

- If you receive a suspicious call, do not share your personal information and also call the actual call center, which you can find by manually typing the website into the browser’s URL.

Source: Tec Mundo

I am a passionate and hardworking journalist with an eye for detail. I specialize in the field of news reporting, and have been writing for Gadget Onus, a renowned online news site, since 2019. As the author of their Hot News section, I’m proud to be at the forefront of today’s headlines and current affairs.