Joyful digital banks It has brought great news for users who no longer want to face queues every time they want to make a payment or transfer and still pay for certain bank transactions. This NubankAs a pioneer in its field, it continues to invest in technology and innovation to attract more people interested in the digital world.

Recently, platform developers, Nubank Celular Seguroconsists of insuring your device more practically and quickly. Do you want to know this? Check out all the details below!

Nubank Celular Seguro: understand how it works

Initially, the service was only available to certain users of the bank, but now it can be rented by anyone who wants more security in their own pocket.

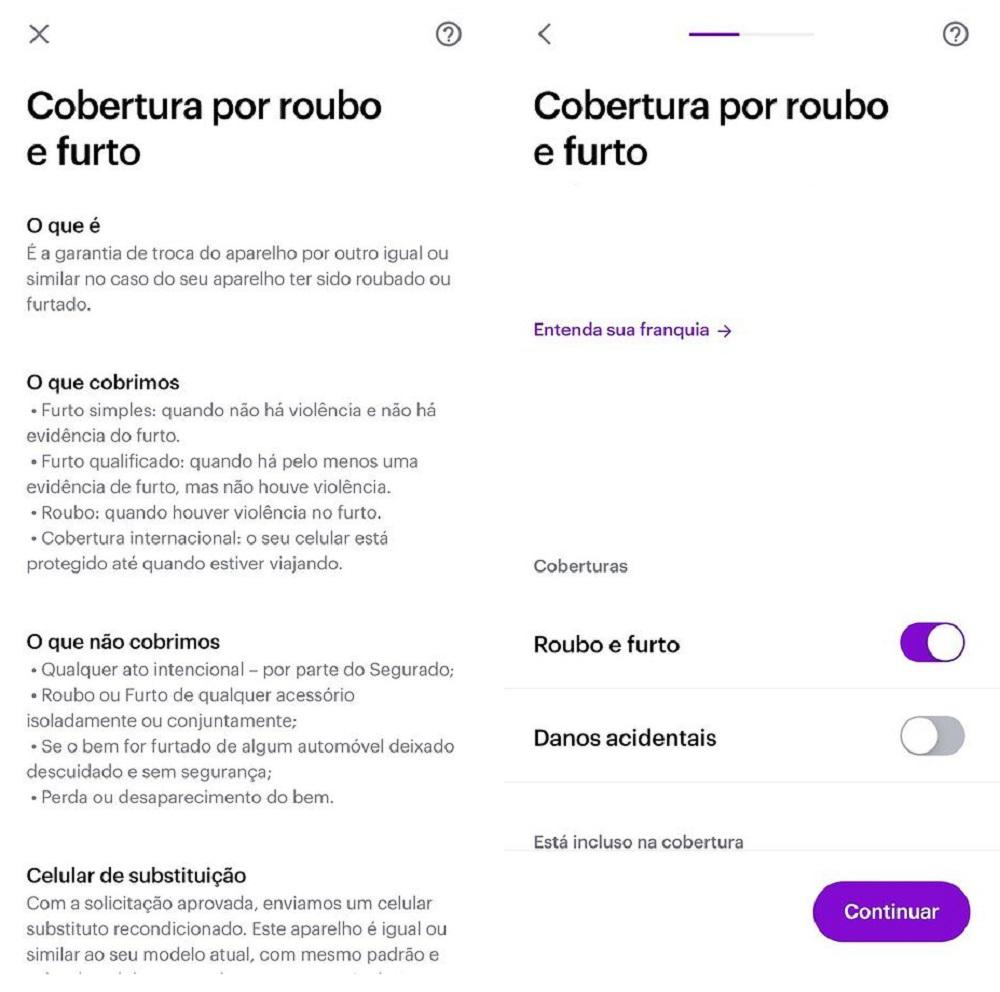

in case of theft, robbery, or accidental damageYou can activate the 24-hour insurance. Applies to different models, including mobile phones purchased outside of Brazil. In addition, if any of these problems occur abroad, you will have a guarantee through Nubank Celular Seguro.

Despite all these advantages, it is also important to emphasize that when hiring the service. 30-day grace period counted from the day the plan comes into effect. This means that you have to wait for this time to expire to trigger the fuse for the first time.

How much is Nubank mobile phone insurance?

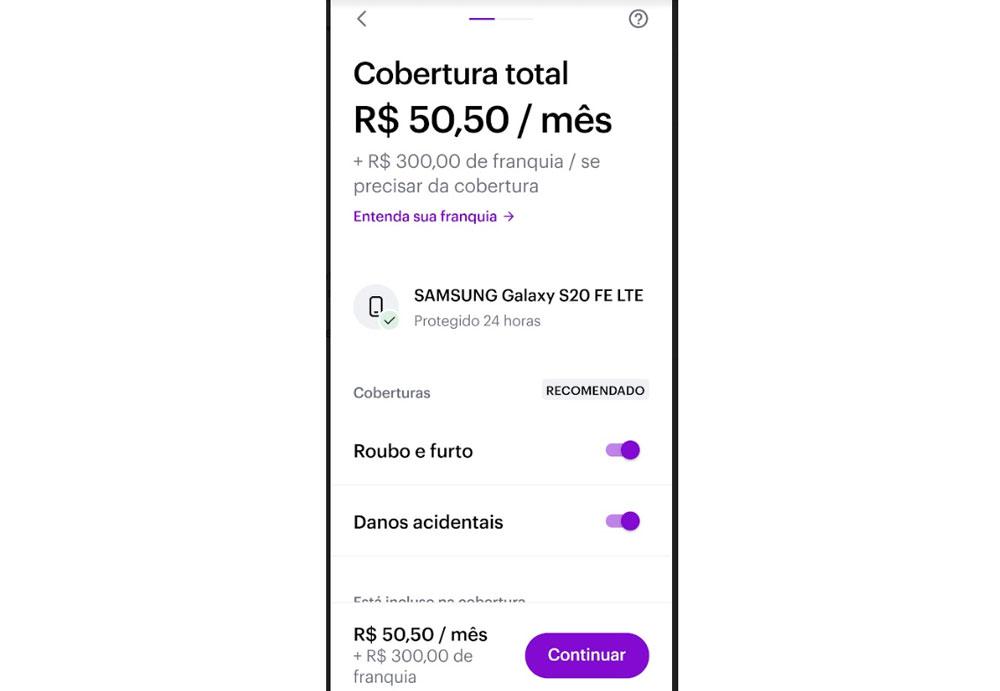

It is also worth noting that The amount to be deducted from the insurance varies according to the mobile phone model. and also the coverage desired by the consumer. The platform offers options to cover “accidental” and “theft and robbery” damage.

In a simulation by TecMundo with a Galaxy S20 FE mobile phone, the full coverage value was R$50.50 per month, in addition to a R$300 deduction.

Take a step-by-step look at signing Nubank insurance

Nubank’s mobile phone insurance can be accessed through the bank’s application. To simulate or rent, follow these steps:

1. Search for “Seguro Celular” in the app, then tap “I want to know more”;

2. Press the purple arrow to continue and enter your device’s fingerprint IMEI number (International Mobile Equipment Identity);

3. If you still do not know what this number is, tap “Where is the IMEI” and follow all the instructions that appear on the screen;

4. From now on, you will be able to choose between two available insurance options: the first is for theft and robbery or accidental damage only, and the second is fully covered;

5. When changing the type of guarantee, please note that the amount to be paid monthly will change. This value will be specified at the end of the transaction before it is confirmed;

6. Continue to choose the payment method: Credit Card or NuConta.

7. A summary of the agreement will be displayed on the screen. You can also read it in full under “Terms and Conditions”. If all is well, tap “Contract Insurance” and enter your 4-digit password.

8. After one month, you can change your coverage plan and still claim your insurance for the first time.

It is important to note that the invoice amount will be equal to the service contract amount and if this date is a Sunday or a holiday, invoicing will take place on the next business day. To activate the insurance, simply contact the bank’s customer service team via the app’s chat, phone 0800 608 6236 or email meajuda@nubank.com.br.

Source: Tec Mundo