We often don’t pay attention to how familiar things become part of our lives. For example, a regular ATM that each of us brings at least once every two days.

Have you ever wondered how it works, why it doesn’t make mistakes in counting money, and what’s inside? If not, you’re wrong, it’s very interesting. I studied this issue myself, I share experimental interesting facts about ATMs and their history.

Briefly

It all started with a bankograph

Who invented the ATM?

Radioactive money was a reality

How a modern ATM works

Why it is useless to hack an ATM

It all started with a bankograph

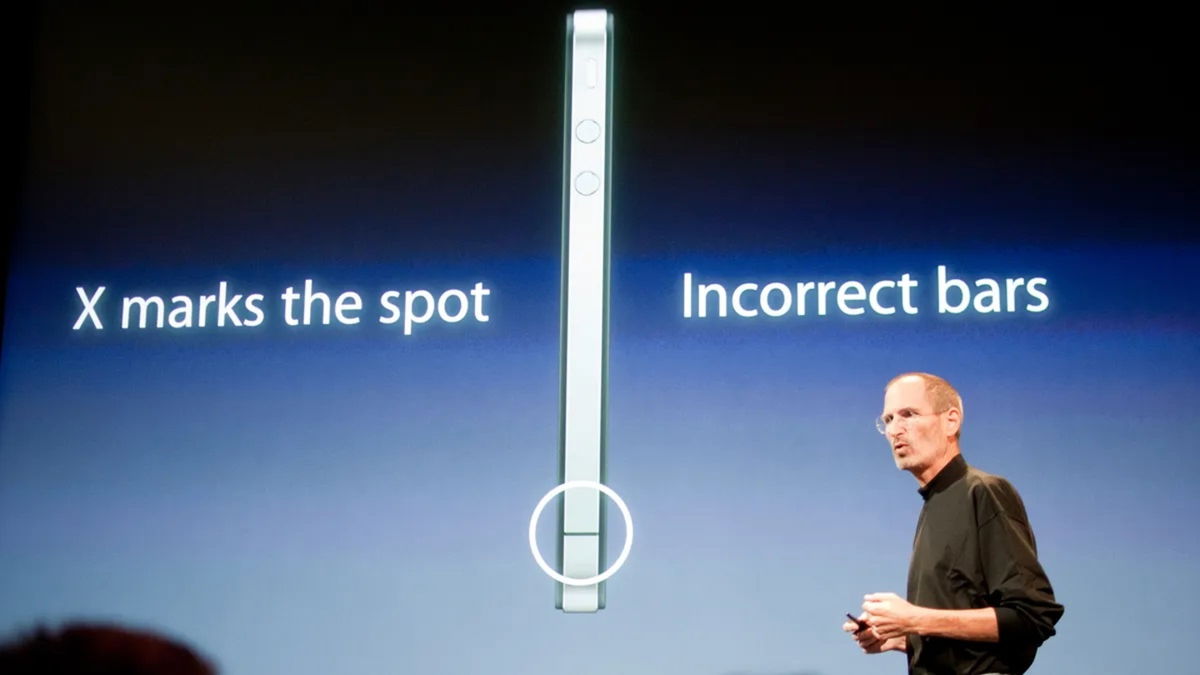

The opening of the first ATM in London, 1967.

The opening of the first ATM in London, 1967.

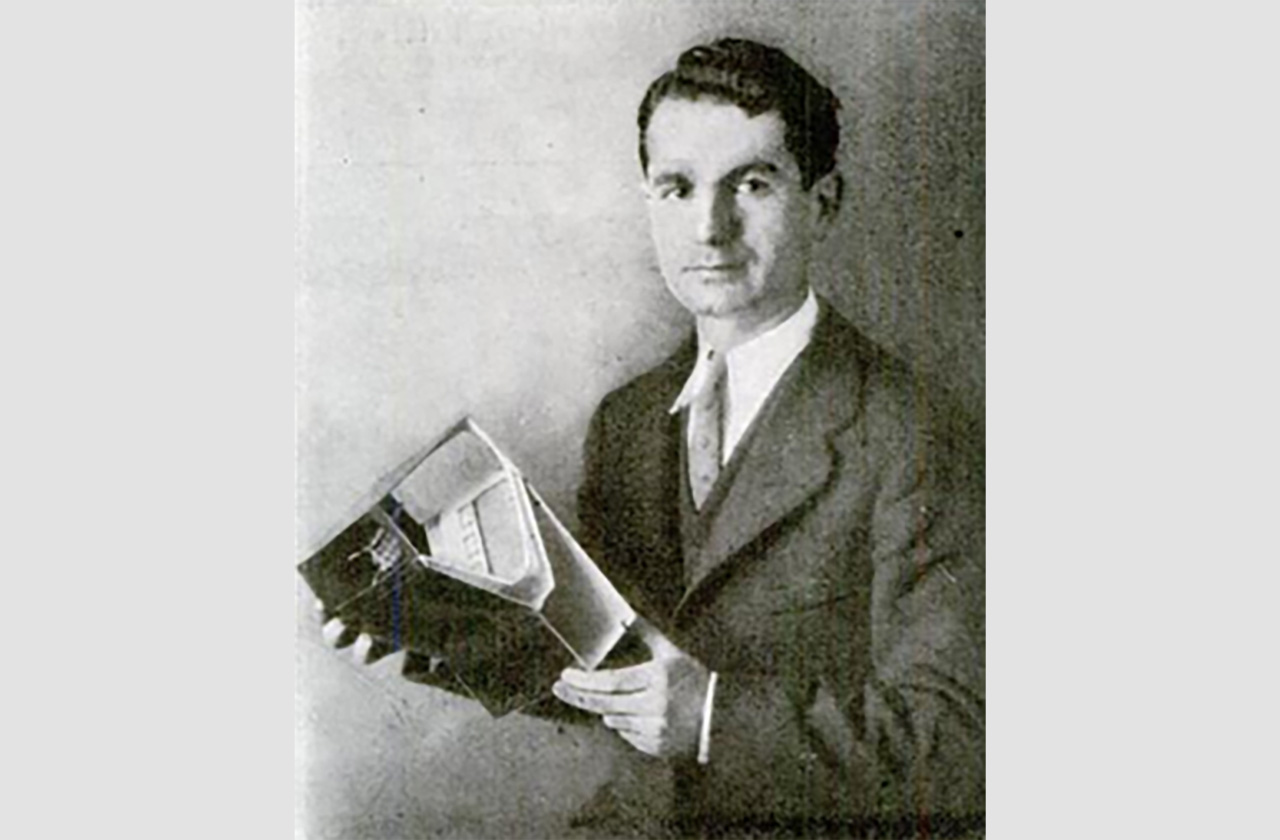

Surprisingly, the first ATM was discovered not by a company, but by one man – the respected Armenian-born scientist Luther George Simjian.

It was he who created the first mechanical ATM. True, the device was originally called “bankograph“.

Luther George Simjian was a very gifted man. Between 1927 and 1982, he received over 200 US patents. Among them is the “Position-Reflective System for a Photographic Instrument,” better known as the Reflector.

Luther George Simjian was a very gifted man. Between 1927 and 1982, he received over 200 US patents. Among them is the “Position-Reflective System for a Photographic Instrument,” better known as the Reflector.

It was assumed that bankograph would issue cash upon the customer’s check request. But since the device was not linked to a bank, it was impossible to write off money from the account.

Because of this, mass production did not begin, and the invention was forgotten for 30 years. Unfortunately, there is not a single photo of this device on the Internet.

◦ Back to Contents ◬

Who invented the ATM?

The first person to receive money through the device was comedian Reg Varney.

The first person to receive money through the device was comedian Reg Varney.

The birthday of modern ATMs is considered to be June 27, 1967On this day, the world’s first cash withdrawal ATM was launched at a branch of the British bank Barclays in the Enfield area of north London.

The idea and development of this device was the work of an individual Scotsman, John Shepherd-Barron.

John Barron realized that the idea for a cash dispenser came to us unexpectedly. One day he was unable to withdraw money from his account because the bank branch was closed.

As John recalled in an interview, he thought there must be a way to get your money anywhere in the world, or even in the UK. So he decided to create a machine similar to the one that dispenses chocolates, but with the hope of dispensing cash instead of chocolate.

◦ Back to Contents ◬

Radioactive money was a reality

Radioactive money, literally.

Radioactive money, literally.

In 1967, there were no plastic bank cards. To get money from an ATM, you had to go to the bank and get a check (the last one available for withdrawal does not exceed 10 pounds), first indicate its denomination and insert the check into the ATM.

The check had a segment impregnated with carbon-14, a low-radiation isotope. This element contained information about the PIN code (it was registered by the bank employee when issuing the check), which the client entered using the keyboard.

Interesting fact: The concept of the PIN code was invented a year before the first ATM was released. According to legend, James Goodfellow, the inventor of the PIN code, originally planned to use a six-digit code.

However, he later reduced it to four digits, as that was how many he thought could replace his wife. Since then, PIN codes have become widely used to protect bank accounts from unauthorized access.

◦ Back to Contents ◬

How a modern ATM works

Since the first bankers appeared, they have changed a lot. The main significance of the innovations was the connection to the Internet for communication with the bank and the Cash Recycling system.

The latest authorization for ATMs to dispense cash from a common pool of money deposited into them.

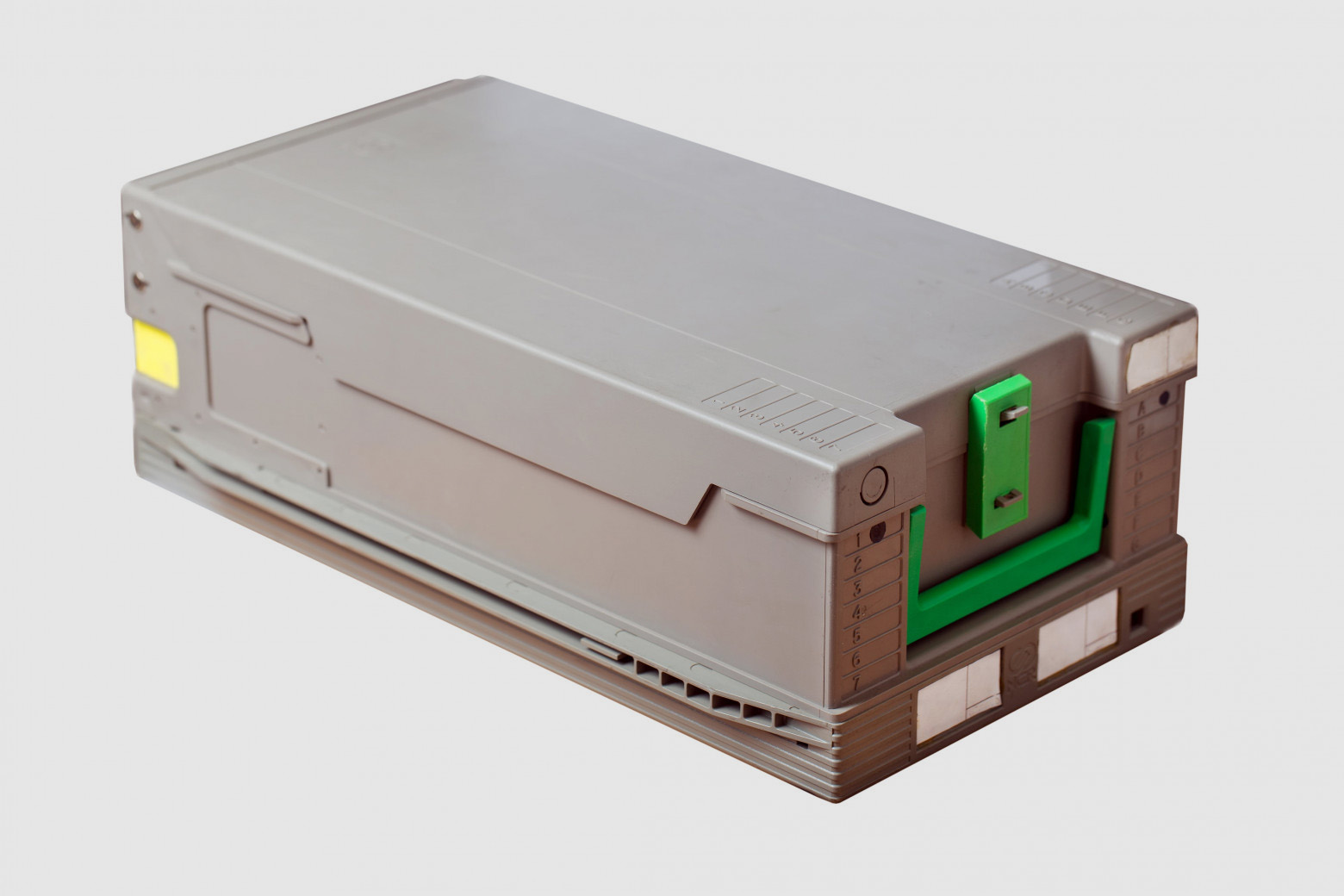

Cassette for storing banknotes

Cassette for storing banknotes

Today, ATMs can be found almost everywhere, and they all have a similar light. Inside the ATM case there is a metal box divided into cells where the cassettes are placed.

Carefully place the bills of the same nominal amount in each cassette (this is a fact, not just a comparison). A special mechanism is used to extract money from the cells. This set of elements is called a safe zone.

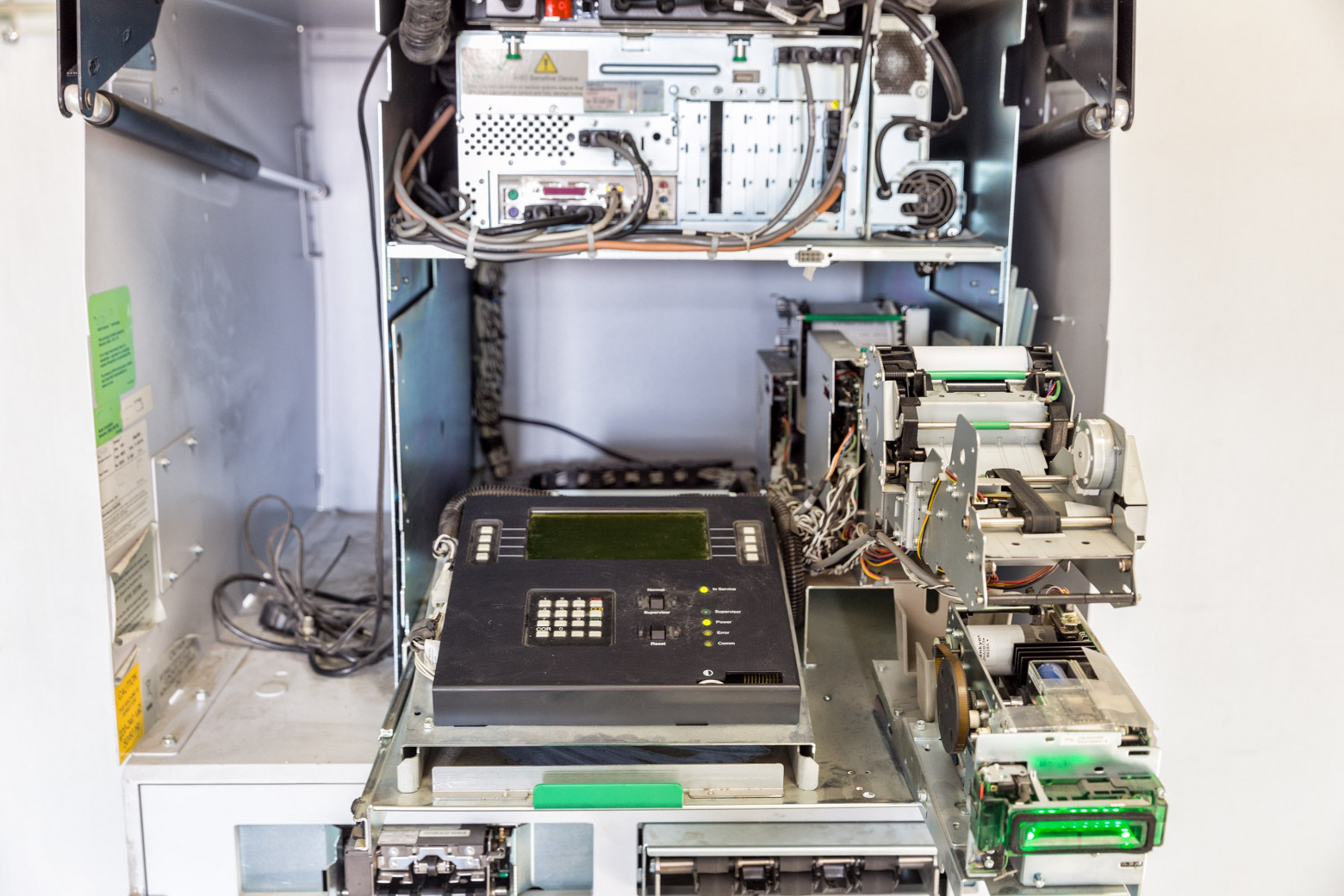

Above the drawer are the keyboard and display. On the display is a computer with software (Previously it was Windows, but now everyone is switching to Linux), which controls the operation of the ATM. This part is called service zone.

The ATM in the open position. This is what the cassette chamber looks like. The banknotes inserted are not examined in the drawer with cells, but in a separate cassette. As a rule, it is located at the bottom of the device.

The ATM in the open position. This is what the cassette chamber looks like. The banknotes inserted are not examined in the drawer with cells, but in a separate cassette. As a rule, it is located at the bottom of the device.

Each bank is also equipped with a video camera for security, a printer for printing receipts, a card reader for reading cards, a Wi-Fi module for contactless cards, a bill counter and a module for communication with the bank.

But what happens to something when they go to an ATM? Why do they go into the cassette?

From the cash storage compartment in the receiver’s transport mechanism. This mechanism sends them to the validator. The validator’s task is to check the denomination, currency and historical validity of the banknotes. For this purpose, the check has a second additional scanner, a set of sensors and electronic templates of all banknotes that move in the direction of growth.

To the point:

How does the validator work in an ATM and why it is better not to deposit money in the morning

After a number of sensors (simple and thin to foreign objects and the quality of the banknote itself) check the historical authenticity of the banknote, the process begins escrow — an intermediate node between you and the bank. This is a module for temporary storage of banknotes, which works until you have correctly performed an operation at the ATM.

Together, the receiver, conveyor and validator resemble the device used in banks to count coins and verify their location.

Together, the receiver, conveyor and validator resemble the device used in banks to count coins and verify their location.

Immediately after you confirm the transaction, place the banknotes into the cassette.

They will be picked up by collectors or sent for recycling – re-issuance to other people. The bank transfers the processing data to your card.

Usually ATMs have two outputs for issuing banknotes: uniform and thin. When the number of banknotes of different denominations increases in the cassette, the same thing is output. And with the thin method, you get the inclusion of banknotes so that you do not have to waste time counting them.

Usually ATMs have two outputs for issuing banknotes: uniform and thin. When the number of banknotes of different denominations increases in the cassette, the same thing is output. And with the thin method, you get the inclusion of banknotes so that you do not have to waste time counting them.

Getting money from an ATM works the same way, but in reverse. When you select a withdrawal method, the server sends an ATM command indicating which bills to withdraw from a cassette of a certain denomination.

The issue includes all customers loaded into the issue cassettes. The filling of the cassettes is monitored online: special sensors are installed in them.

Now that we understand how it works like an ATM, let’s discuss why it is almost impossible to hack and what consequences this can have.

◦ Back to Contents ◬

Why it is useless to hack an ATM

It means an obvious fact – you shouldn’t break the law. Firstly, you’ll find out, and secondly, you can suffer greatly in the process of breaking it.

ATM protection against hacking on two levels: software and mechanical. We already talked about software protection in the previous section.

The main foreign resources of banks are the validator and the pressure center. The latter is a special server function that sends commands to issue money, issue cards, checks, information about the status of the counter, etc. Usually, such servers are maximally protected by the mechanisms of the bank itself, and it is almost impossible to bypass them.

Therefore, criminals most often resort to mechanical methods of hacking. However, there is a nuance here. Even if the criminal manages to open the ATM, which, in principle, is not so difficult, he will face the main problem.

Purchased “marked” banknotes are unsuitable for use

Purchased “marked” banknotes are unsuitable for use

In case of unauthorized opening of the ATM safe, when the ATM position changes (shaking), the external impact system on the ATM turns on an audible signal, which starts the cassette protection.

At the same time, the system of coloring all bows with special indelible paints is automatically activated.

An example of an attempt to blow up an ATM. The attempt was unsuccessful.

An example of an attempt to blow up an ATM. The attempt was unsuccessful.

Sometimes criminals try to blow up an ATM to bypass the protection inside the cassette. This is, of course, a very loud and often useless method, which sometimes ends sadly for those who use it.

There are several known cases where the hapless robbers died.

To the ATM – only for independent

I hope you found it interesting. Surprisingly, many simple and familiar things turn out to be very complex and contain unexpected technical solutions.

Thanks to everyone who read to the end. Have a nice day!

◦ Back to Contents ◬

Source: Iphones RU

I am a professional journalist and content creator with extensive experience writing for news websites. I currently work as an author at Gadget Onus, where I specialize in covering hot news topics. My written pieces have been published on some of the biggest media outlets around the world, including The Guardian and BBC News.