Zeng Yuqun has been called China’s prolific billionaire. He is the founder and CEO of CATL, a company that makes batteries for electric vehicles.

CATL customers include Tesla, BMW, Volkswagen, Toyota, Honda, Hyundai and Kia. Zeng Yuqun himself is ranked 29th in the list of the richest people in the world according to Forbes. In Bloomberg Green’s list of the world’s largest eco-billionaires, Yuqun is second only to Elon Musk.

Musk often makes headlines in the media, but Yuqun has about the same power and includes an entire industry.

CATL’s first customer was BMW

In 2010, Zeng Yuqun met Herbert Diess, who was a BMW purchasing manager at the time. Diess is currently the CEO of Volkswagen, and in 2010 met with numerous cell phone battery makers. He convincingly proved them to establish the production of batteries for electric vehicles.

At one of these meetings, Diss met Yuqun, who at that time led the subsidiary of the Japanese electronics company TDK. Recalling this meeting in May 2022, Diess described Yuqun’s initial version as dismissive as he could not produce such large batteries.

The idea of batteries for electric vehicles hooked him. In 2011, Yuqun led a takeover group that acquired 85% in TDK’s electric vehicle battery business and named the new company CATL.

BMW was his first identity.

Diss led our company into the automotive battery business. I am grateful to him for this.

Zeng Yuqun, founding member of CATL

Batteries themselves were nothing new to Yuqun. In the early 2000s, he patented mobile phone batteries in the US and took part in improving battery design.

According to Lei Xing, former editor-in-chief of China Auto Review, when BMW agreed to CATL as a battery supplier, Yuqun completely read 800 pages of security.

Zeng Yuqun

The attention the billionaire had to technical details was of the utmost importance. When CATL began producing car batteries, another Chinese company, BYD, showed growth in the market. At the time, BYD was using lithium iron phosphate batteries and CATL was promoting the introduction of nickel, manganese, and cobalt (NMC).

The NMC had a long range. And when China increased subsidies for electric vehicles in 2015, long-range batteries received more support. This helped CATL a lot.

Lei Xing, former editor-in-chief of China Auto Review

Subsidies have been a significant part of CATL’s success. From 2009 to 2021, Chinese buyers received about $14.8 billion in tax credits on electric vehicles. But the rebates were given if parts made from China were found in electric vehicles. This stimulated demand for CATL not only among Chinese electric vehicle manufacturers, but also among international companies that wanted to enter the commercial market of China.

Between 2015 and 2017, Yuqun is raising more than $2 billion to invest in the supply chain. As a result CATL took full control of the entire battery production process, from naturally mined minerals, ending with the recycling of used batteries. In 2018, CATL went public with an IPO.

Today CATL is detected with automakers detection

CATL’s focus has been on the German market. It opened an office in Germany in 2017 before applying production subsidies to EV battery makers.

According to Ferdinand Dudenhöffer, director of the German Center for Automotive Research, Germany, which produces more cars than any other European country, quickly recognized the dangers of working with Chinese firms.

The industry knows that China is very important. If you don’t keep in touch, do business, and do joint research with Chinese enterprises, you won’t stick to the most common positions.

Ferdinand Dudenhöffer, director of the German Automotive Research Center

But as electric vehicles develop, automakers become dependent on other companies. For example, Tesla has agreed on fuel with BYD.

General Motors, another CATL client, is designing a new battery manufacturing plant in the US in partnership with LG Energy Solution. Toyota wants to open a battery plant in North Carolina and Ford is building two battery plants in Kentucky.

CATL has a huge impact on the industry and often dictates the terms, said Mark Griven, Professor of Innovation and Strategy at IMD Business School. The company imposes its contracts for 5 years and does not want to impose its batteries on different automakers.

According to Griven, CATL follows a “take it or leave it” strategy. But this position is pushing automakers to consider partnering with smaller businesses that may have less experience but are willing to modify their products to suit requirements.

In the same time likelihood of addiction to CATL. It has been found that it is difficult for car manufacturers to produce batteries at sufficiently low prices, especially without the scale and expertise of CATL.

Under sector control, CATL has doubled the number of its R&D employees. It has hired 10,000 people from 2020 to 2021 to explore new battery production.

CATL develops powerful sodium-ion batteries. In the case of successful experiments and the launch of mass production, this will seriously strengthen its position.

Sodium is the sixth most common demand on Earth, and batteries using it will reduce the automotive industry’s dependence on Lithuania, which is expected to run out as early as this year.

CATL is the largest manufacturer of automotive batteries in the world and in China. Part of the problem

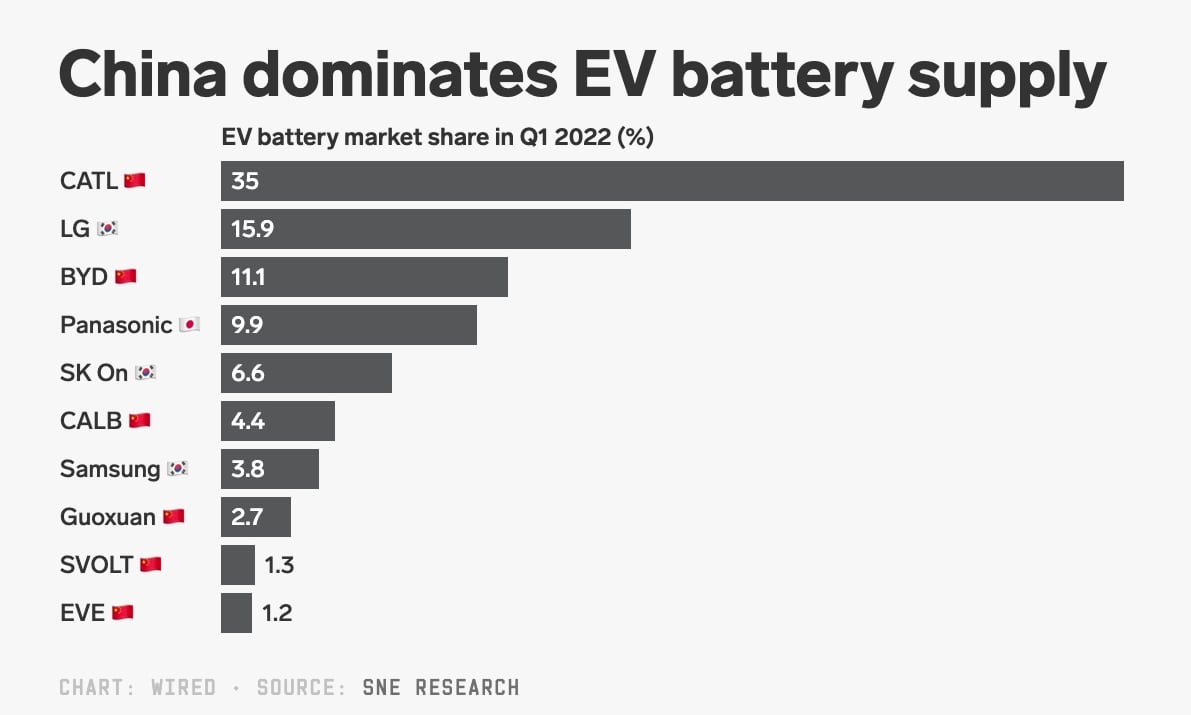

China produces 44% of the world’s electric vehicles and 80% of lithium-ion batteries. In the short term, this share will grow.

6 out of 10 major EV battery manufacturers are Chinese enterprises. Among them, CATL ranks first with a share of 35% of the total world production.

The presence of dangers CATL may not be shaken by automakers, China itself. In November 2021, the Shenzhen Financial Exchange drew attention to the “excessive” funding of CATL.

The Chinese authorities could sharply reorganize the grand total if it reduces the scope of party ambitions. There are already hints that can be reflected in CATL.

In 2015, enterprises authorized by the state-owned aerospace company co-founded CALB, a state-owned firm that also manufactures lithium-ion batteries. Such a move could turn CATL against China itself.

The two firms have already clashed. CATL charged CALB with patent infringement and damages of 518 million yuan ($77.4 million). The legal dispute escalated just as CALB was poised for an IPO on the Hong Kong Stock Exchange later this year.

CALB itself considers itself the second largest electric vehicle battery company in China and the seventh largest in the world. But now, with a state-owned company vying for control of China’s battery production, it’s not certain that this will continue.

Too much dominance is too narrow a place. And this is something that is not needed in any degree, not in the government.

Bill Russo, former head of Chrysler Northeast Asia

In the future, CATL will be expected not only by its technological capabilities, but also by whether Yuqun can deal with Chinese computing capability. [Wired]

Source: Iphones RU