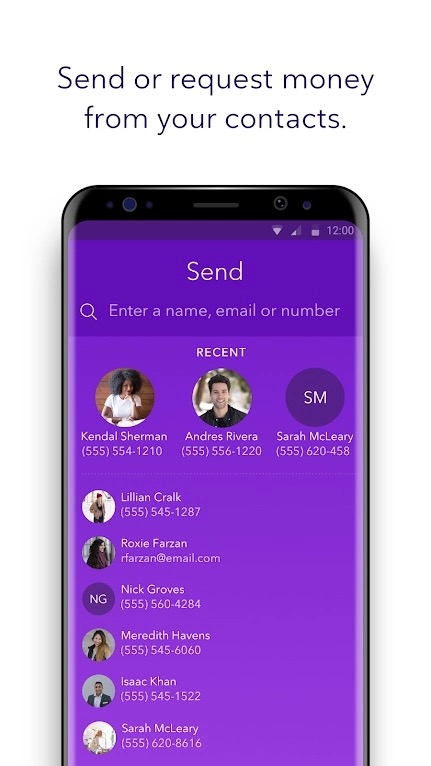

Whether you want to pay your friend for those beers and food he invited or send some money to your nephew for his birthday, a peer-to-peer money transfer app is the most useful thing that can make things easier. Applications for sending money do not require you to enter your banking information. Find out how you can take advantage of these convenient payment options by reading our top options below.

You may also be interested in knowing best messaging apps, The best apps for working from home or also best free cryptocurrency apps.

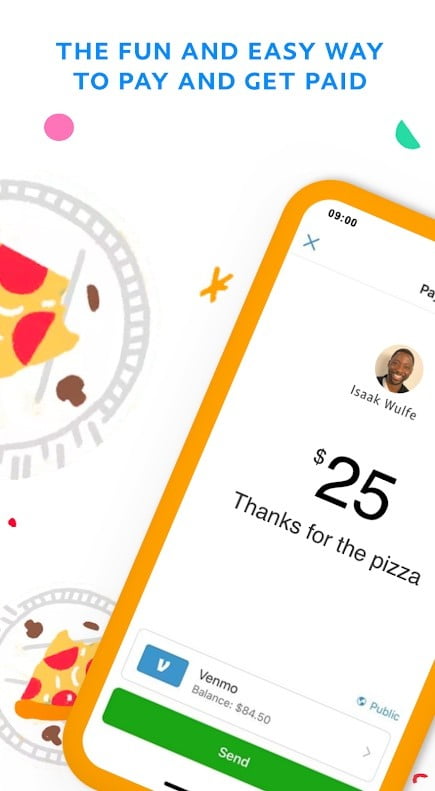

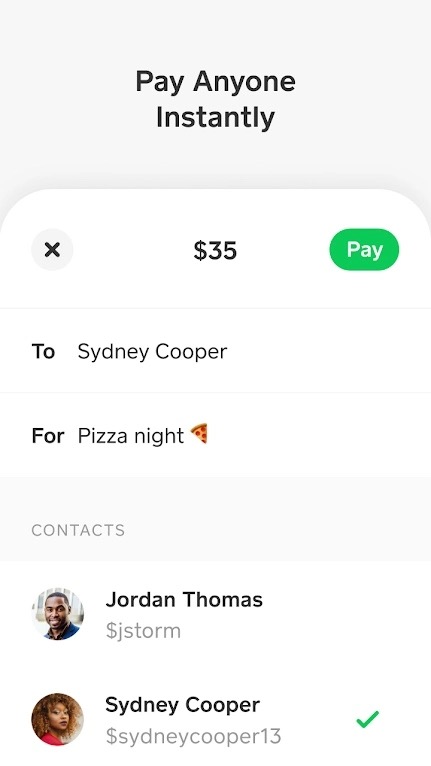

Venmo

We believe this is the best money transfer app on the market. It is incredibly easy to use. Any type of payment made on Venmo, including debit cards and bank accounts, is easy to do. The fee is 3 percent for credit cards. It has a security system similar to banking so you don’t have to worry about hackers that roam the web. The company also offers a Venmo debit card, so you can use it anywhere Mastercard is accepted in the US, and you can even earn rewards.

iOS Android

facebook messenger

The Facebook Messenger app has a feature that allows you to send money to anyone in the US. When you communicate, you have the opportunity to touch dollar sign Located above the keyboard, next to the photo sharing tools and stickers. If it doesn’t appear, tap ellipsis on the right to open a list of additional options. Once you’ve set up your debit or credit card, simply enter the amount of money you’d like to send and select To pay in the upper right corner. Most recently, Messenger has rebuilt the app from the ground up for a faster and easier experience. You can now message or call your Instagram friends from within the app and use the Disappear mode, which makes previously viewed messages disappear after the conversation ends.

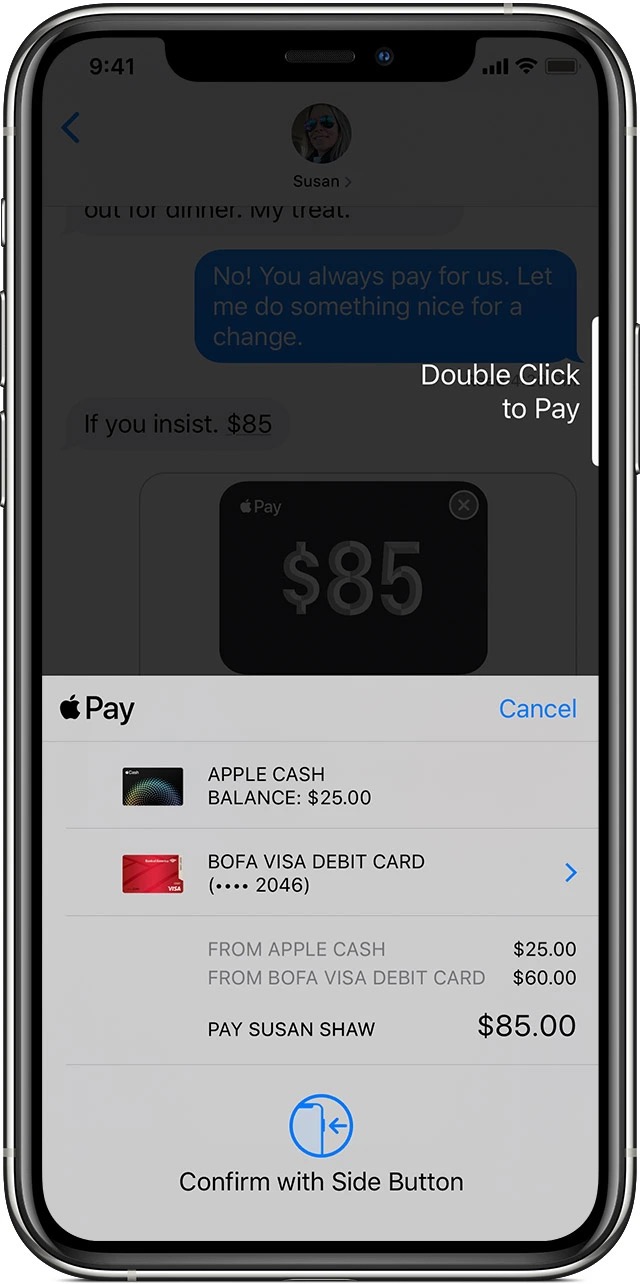

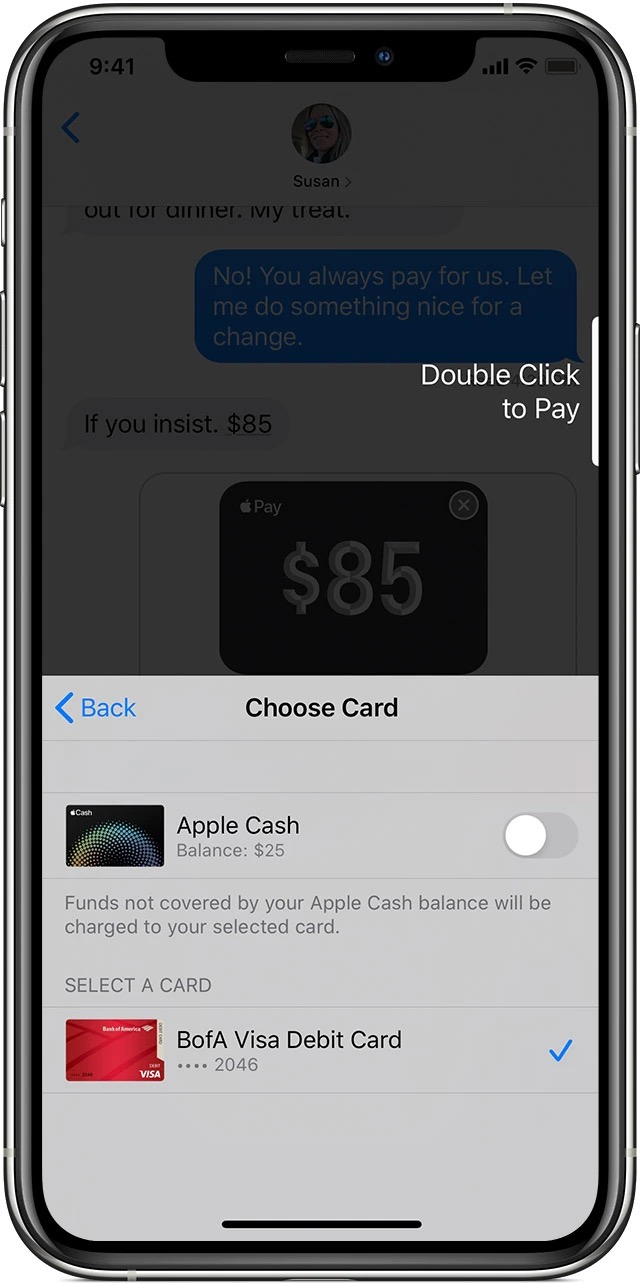

Apple Pay Cash

If you live in one of the countries where you can use Apple Pay — and if you have an iPhone — you’re in luck because you don’t need to install the app if your contact also has an iPhone. During a call, just touch the symbol TO next to the camera icon, then tap To pay. Select an amount and click To pay. You can also request the amount from your contact. Send a message like any other and it will ask you to verify it with FaceID, Touch ID, or your password. Apple Pay Cash is also compatible with iMessage on Apple Watch, and you can even use Siri to send money. Although the money appears on your statement immediately, it takes several days for it to be transferred to your bank account.

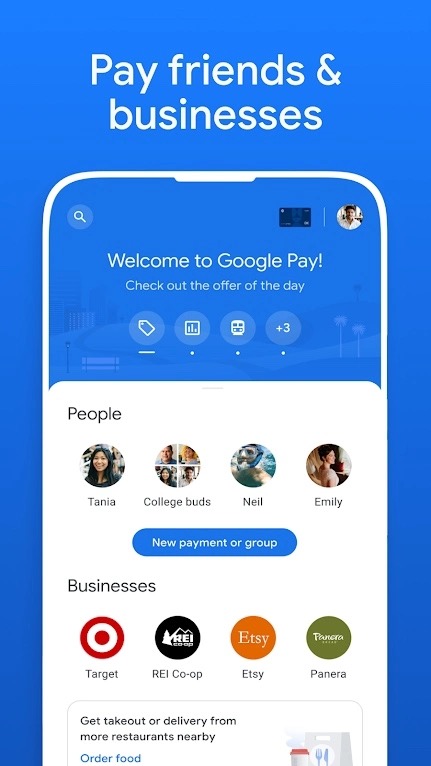

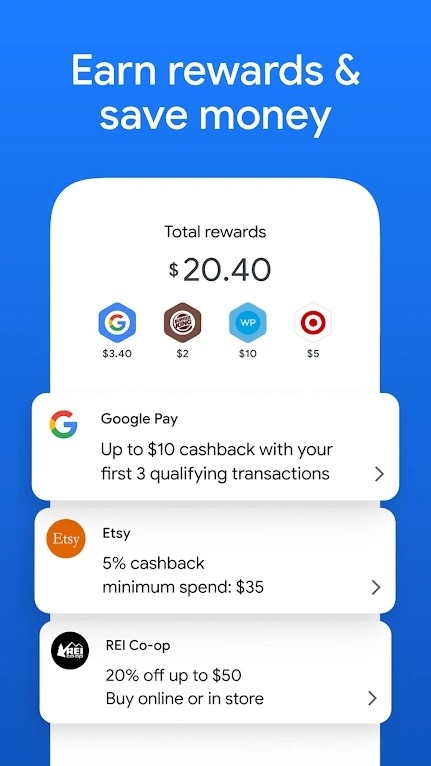

Google Pay

Google has launched a revamped Google Pay focused on personal and business relationships and focused on sending and receiving money, tracking expenses, financial information and rewards. Changes to the interface of the old application improve performance and usability of the application. You can send or request money in private groups, schedule, split and make group payments from your mobile phone and find your friends for quick payment. You can also view recent transactions on the home screen and find past purchases, loyalty cards, tickets and offers in one place. You can link your bank account, Gmail, and Google Photos to search for more transactions. If you have the old app installed, you’ll want to replace it with the new app we link to below by early 2021.

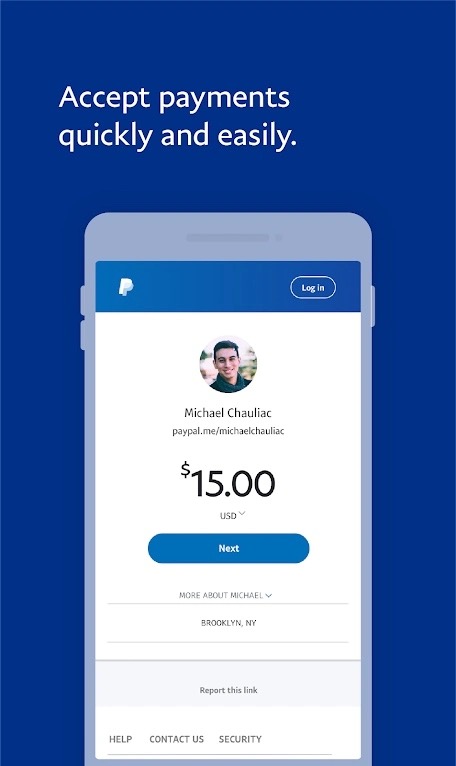

PayPal

PayPal is one of the first money transfer apps. Although it may take a little longer to send and receive funds than with other services, you can also use PayPal to make purchases at various establishments, and you can also use it to make international transfers. Friends and family can send and receive money for free. Businesses that sell products can receive tips from shopping customers using QR codes with the ability to set predefined tips that the customer can select or use in the amount of their choice. U.S. customers can now buy, hold, and sell bitcoin and other cryptocurrencies on the app. PayPal now offers short-term payment plans available to US customers. All of this comes with an extra layer of security, allowing you to verify your identity without having to buy anything.

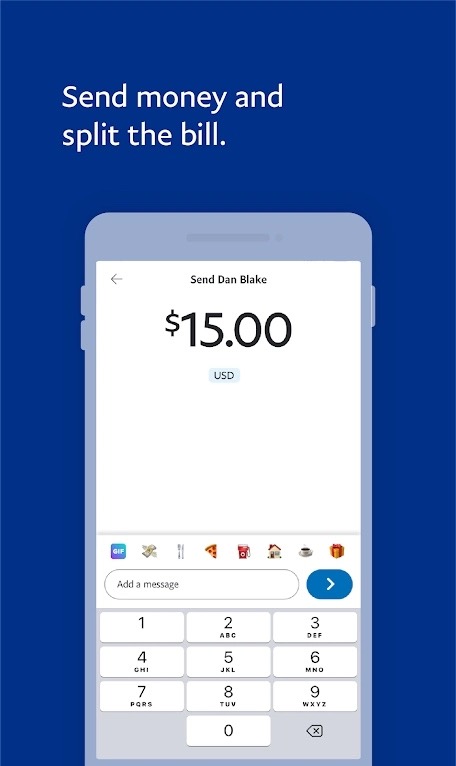

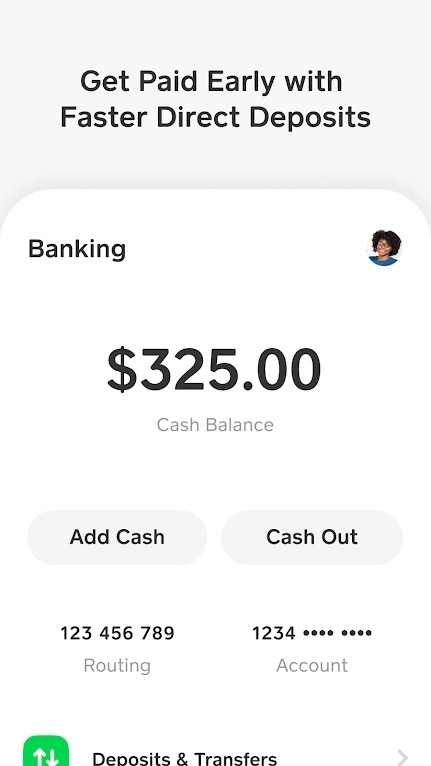

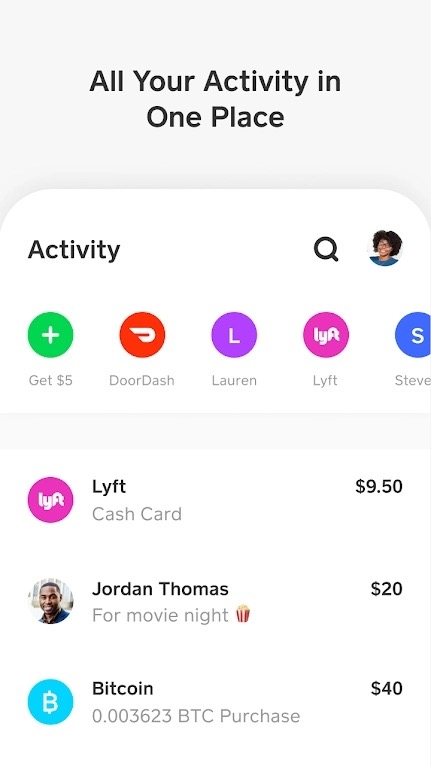

square money

Square Cash allows you to quickly send or receive money. Its most interesting feature is that it deposits money into your bank account immediately after the transaction is completed. You can now see your daily profit or loss in the Investments tab, and when withdrawing bitcoins, you will see the dollar equivalent.

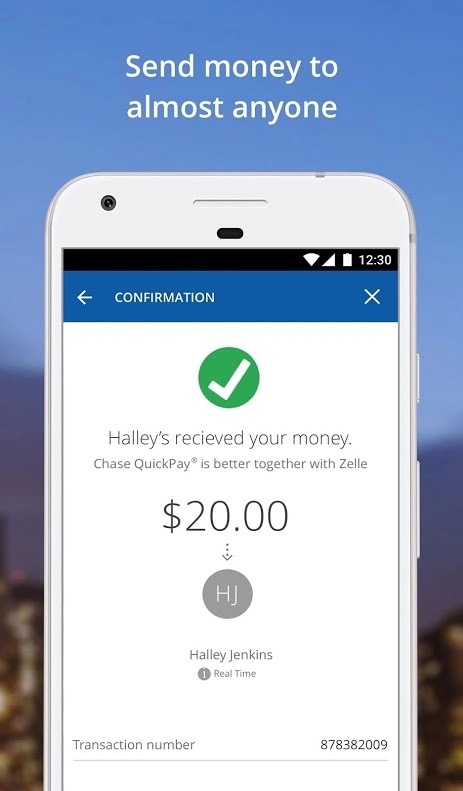

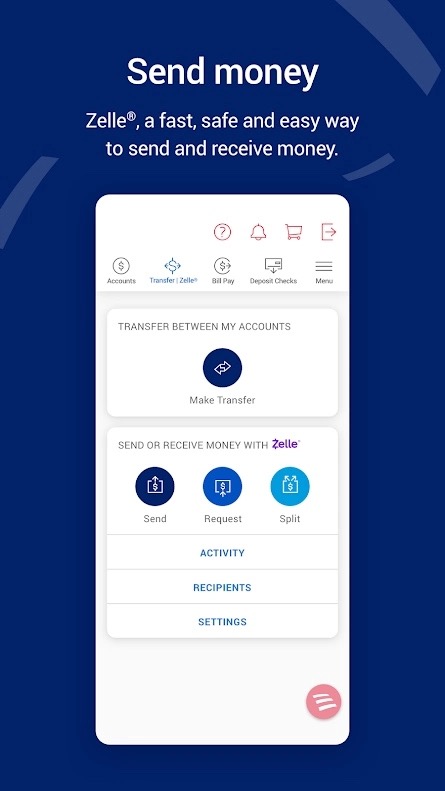

Celle

Zelle partners with banks and credit unions across the United States to provide a secure and easy way to transfer funds to friends and family. Money moves directly from one bank account to another. Using the recipient’s email address or mobile phone number, you can exchange funds without transaction fees. You must have a US bank account to use the service.

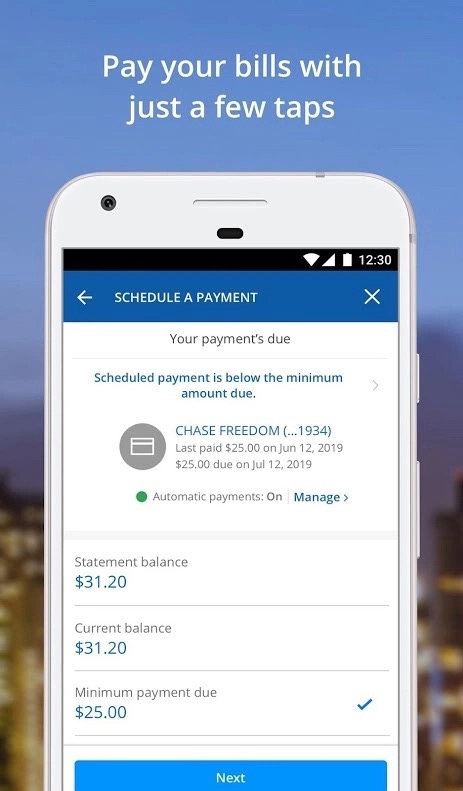

Chase QuickPay

While Chase customers have access to many banking options on the bank’s mobile app, non-customers can send and receive money using the bank’s QuickPay feature and a valid email address. Recent updates allow you to earn statement credits using Chase offers with your eligible credit and debit cards. You can also get new Snapshot features, including monthly credit and debit card usage, cash flow, and expense tracking by category. The app now lets you use quick actions to set up shortcuts to some of your account features, easily search for transactions, and view a summary of your spending. The Chase Mobile app also lets you add a reminder or note to your credit card transaction details and manage your accounts from the improved home screen.

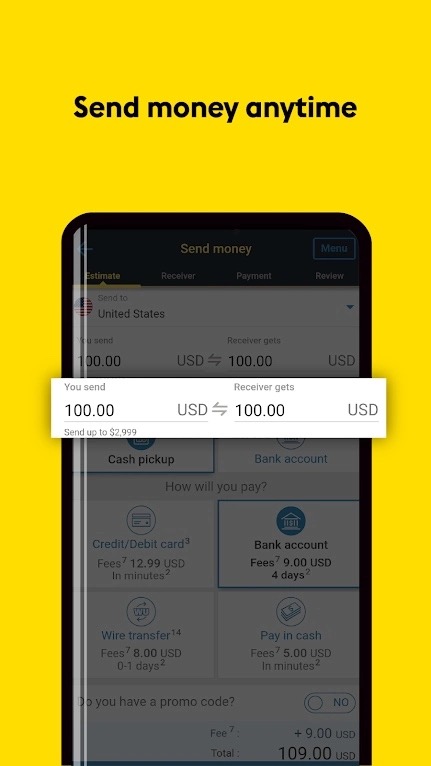

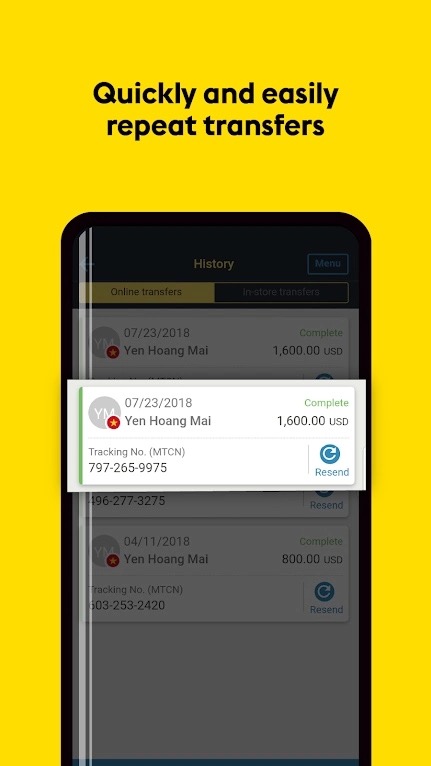

Western Union

The Western Union app allows you to transfer money not only between friends and family, but also to over 200 countries. In addition, you can find out how much your transfers will cost and it will show you the location of all Western Union branches.

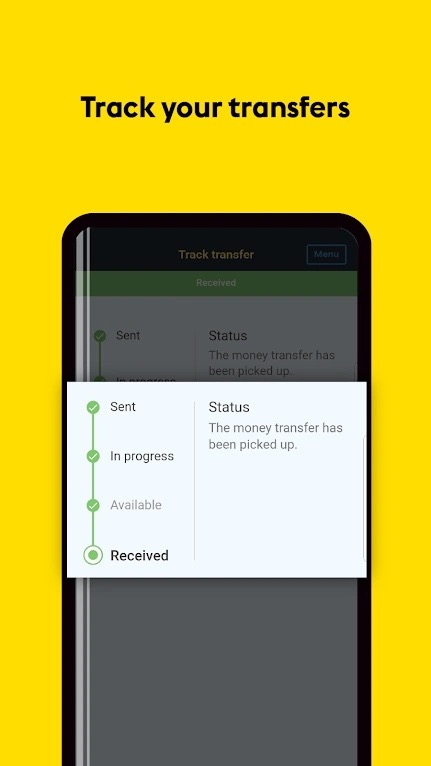

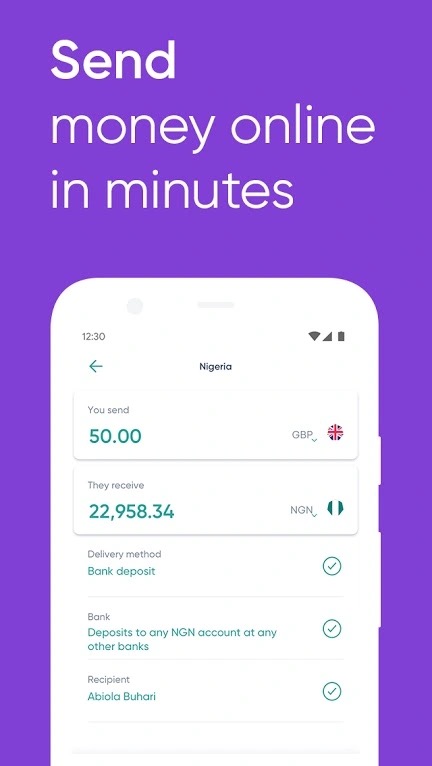

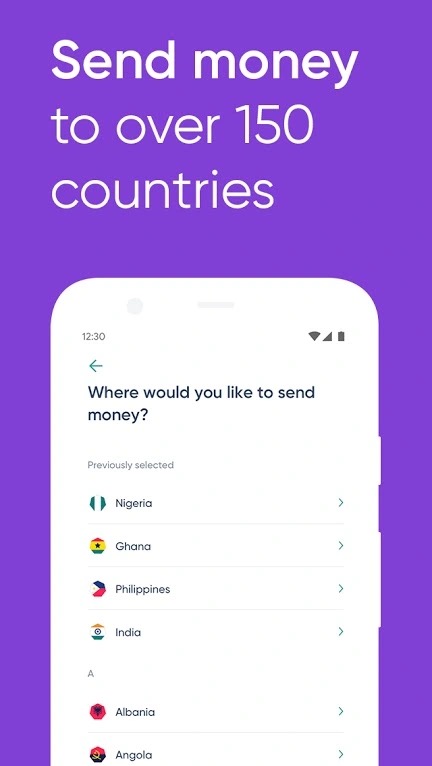

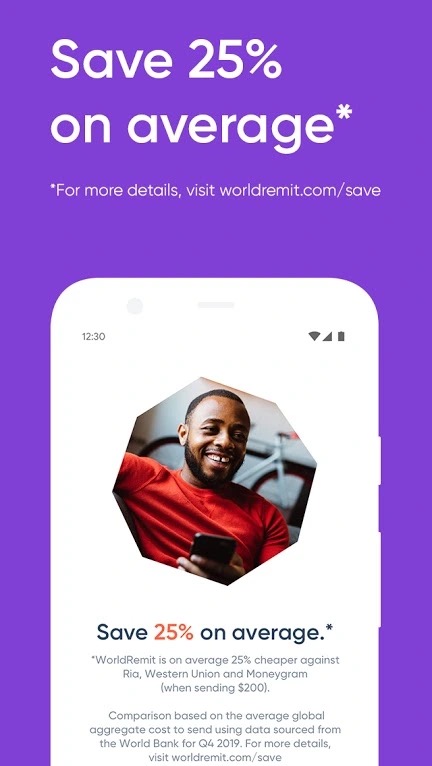

WorldRemit

With WorldRemit, you can send money securely and quickly to your friends and family in over 140 countries. It’s easy to use and the exchange rates tend to be quite convenient. You can also choose how you want the recipient to receive the money. In addition, it allows you to set up SMS or email alerts when the transfer is completed.

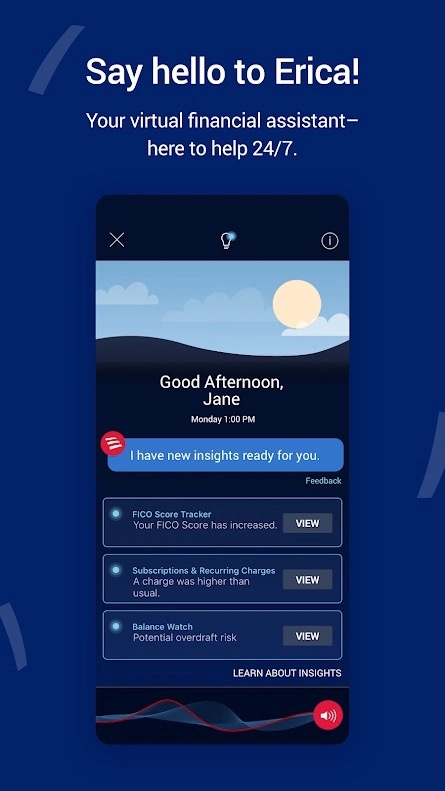

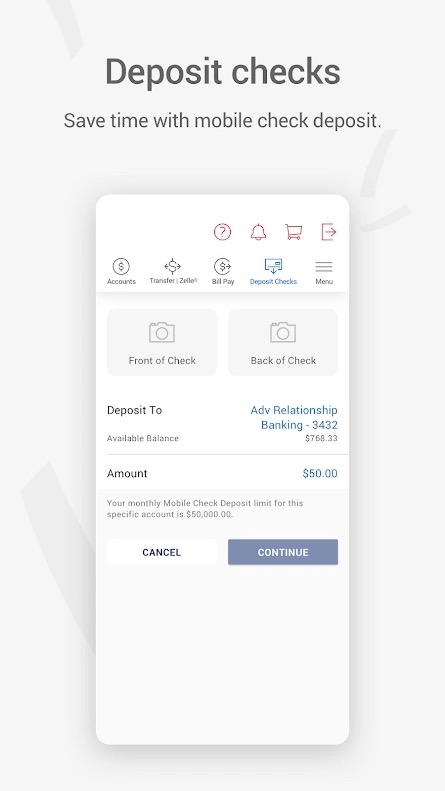

Bank of America

The Bank of America smartphone app not only reduces the time you need to spend in a branch, but also allows you to securely send and receive money to anyone (including non-customers) by phone number or email address. The latest version lets you add emoji when you send or request money with Zelle and get real-time alerts for credit card purchases. The new version adds a search bar with improved functionality, making it easier to access information and features.

PayPal

PayPal is one of the first money transfer apps. Although it may take a little longer to send and receive funds than with other services, you can also use PayPal to make purchases at various establishments, and you can also use it to make international transfers. Friends and family can send and receive money for free. Companies that sell goods can receive tips from shopping customers using QR codes with the ability to set predefined tips that the customer can choose or use in the amount of their choice. U.S. customers can now buy, hold, and sell bitcoin and other cryptocurrencies on the app. PayPal now offers short-term payment plans available to US customers. All of this comes with an extra layer of security, allowing you to verify your identity without having to buy anything.

square money

Square Cash allows you to quickly send or receive money. Its most interesting feature is that it deposits money into your bank account immediately after the transaction is completed. You can now see your daily profit or loss in the Investments tab, and when withdrawing bitcoins, you will see the dollar equivalent.

Source: Digital Trends