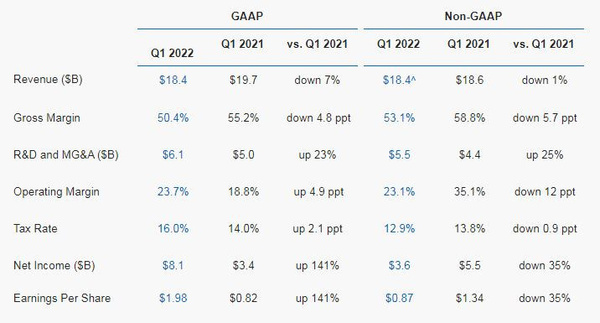

Intel just released its somewhat disappointing first-quarter results for this year. The company reported revenue of $18.4 billion, about 7 percent less than in the first quarter of 2021.

Intel already had low expectations for Q1, although revenues were slightly higher (18.4 versus expected $18.3 billion). The profit margin is lower: 50.4 percent, almost 5 percent less than last year. Strangely, final net income was much higher: $8.1 billion compared to 3.4 billion last year. This probably has something to do with the sale of the antivirus company McAfee, in which Intel still owns a stake.

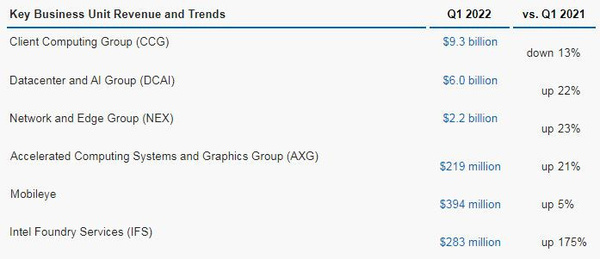

The loss appears to come from the Customer Computing Group, the department focused mainly on the consumer market. Other departments, such as Datacenter and AI Group and Network and Edge Group, saw significant improvements in revenue (22 percent and 23 percent, respectively).

Disappointing quarterly figures are evident in the stock market. Intel’s stock was $47.14 on Thursday, but dropped to $43.74 a day later. At the time of writing, the stock is at 43.59, the lowest since January 2018.

Source: Intel

Source: Hardware Info