Open bank account for children and teenagers It can be important for several reasons. Whether it’s for promoting spending control, teaching financial education classes, or even encouraging the habit of investing, it will probably be the easiest and most practical option. Choose one digital account.

If you don’t know how to open a digital account for teens and kids or if you don’t know the financial institutions that offer this option, we list 6 digital banks which allows opening an account for minors.

Where to open a digital account for children and young people?

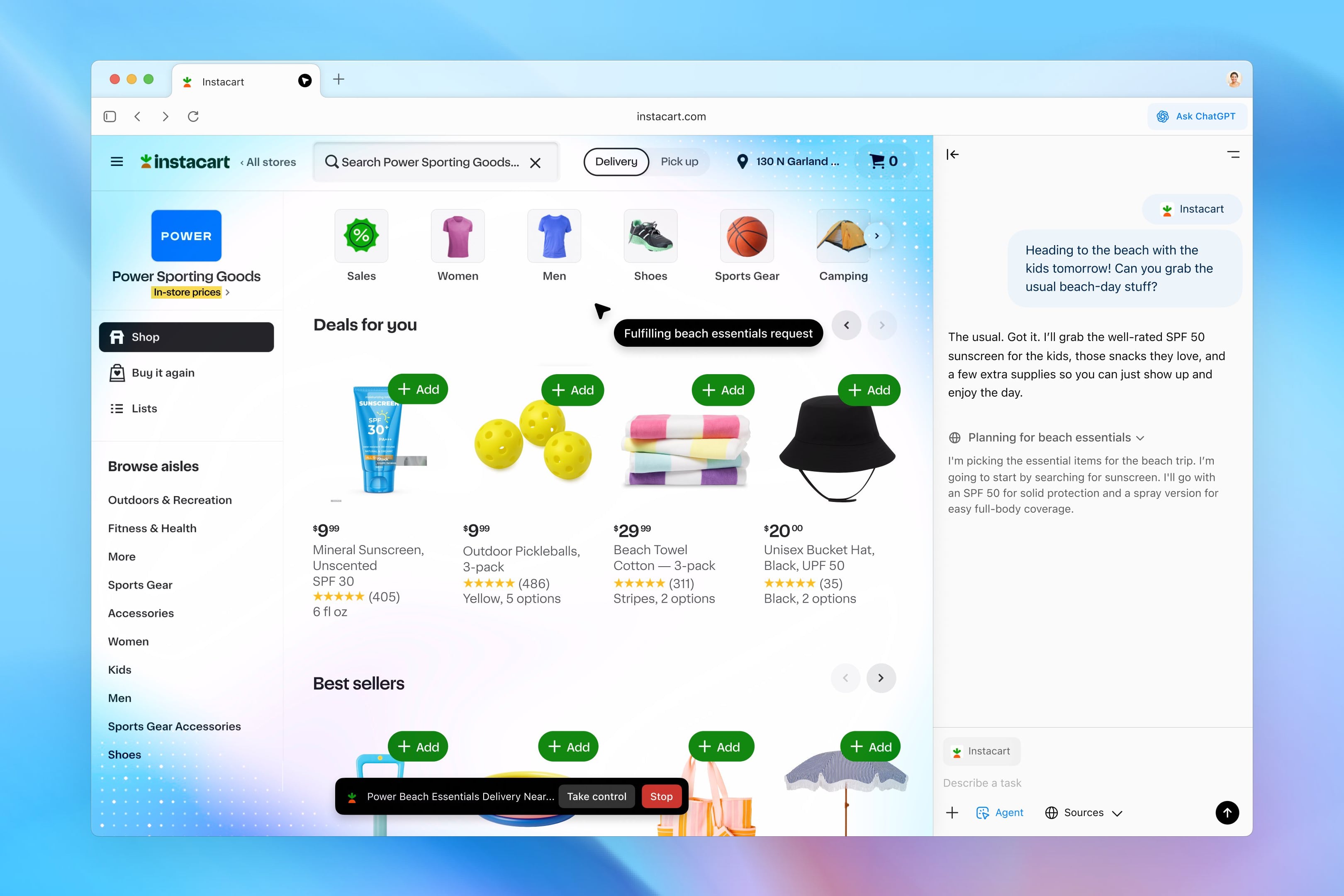

There are several banking options to choose from. Basically they work like a regular bank, but in this case everything is done directly on the mobile screen. You can open accounts, start investments, make transfers, payroll and perform various activities. using only a smartphone and internet – something quite familiar to young people.

Then you can check Six banks offering digital account opening for under 18s:

Interbank

One of the best digital banking options available in Brazil Bankr (Android, iOS) has the option to open an account for minors. known as Child Accountthis modality is specified by the institution itself for those wishing to start. planning and investing in the child’s or adolescent’s future.

Banco Inter’s Child Account too It’s free and offers benefits such as access to a debit card and investment area. In addition, minors can purchase gift cards, receive cash and apply for credit cards if they are free.

HE account opening process digital Kids at Banco Inter is pretty simple, basically the same as adult accounts. The main difference is that in the Child Account, in addition to the child’s documents, the documents of the father, mother or legal guardian must be attached.

C6 Bank Yellow

free digital account C6 Yellow (Available for Android and iOS) C6 Base for persons under the age of 18, personalized debit card and with approximate payment option, all controlled by proprietary apps. The minor can pay, transfer (including PIX), view the statement and learn about financial education directly in the app.

C6 Yellow is linked to an adult’s active C6 Bank account; monitor the spending of minors, as well as accessing the expression and the actions the teenager made. It is even possible to receive SMS on every purchase made using a Yellow card, for added security for the legal guardian.

In addition to tracking expenses, the responsible adult can also schedule monthly transfers by automating the allowance.

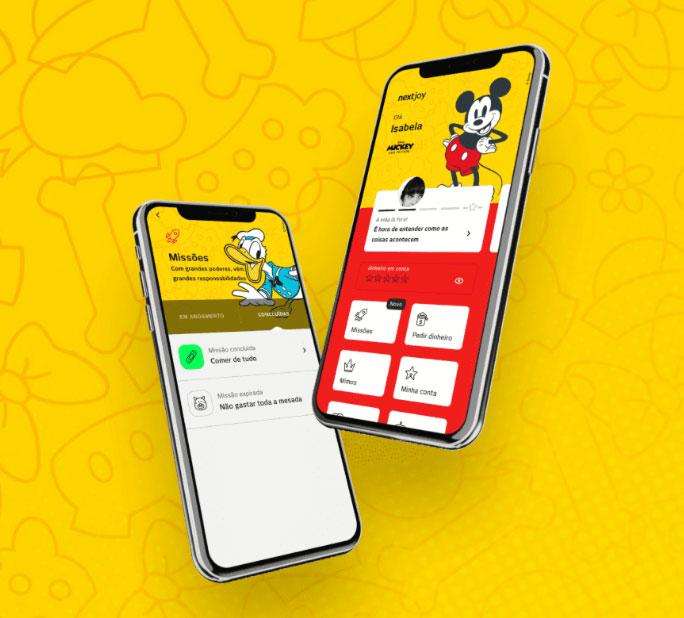

nextJoy

Aimed at children and teenagers up to 17 years old and with versions of the app available for Android and iOS, nextJoy from Banco Next is a modality 100% free Bradesco account The result of collaboration between the financial institution and Disney. The app can be customized with themes inspired by Disney characters, including Marvel and Star Wars heroes.

nextJoy offers several tools for guardians, including the option to enable it. planned allowance and even set alerts for watch movements made to the account of the minor.

One of the highlights of this digital account is the way it is implemented. Gamification in daily life under 18turning daily tasks (such as washing dishes, cleaning the room and saving pocket money) into tasks that can be followed through the app.

PicPay

known as one. most popular digital wallets available in the market, PicPay also offers digital accounts for minors with the app available android and iOS. However, in this case, the young person must be at least 16 years old at the time of opening the account.

The young person is given a bank card (and can also create a virtual card to use on the internet) and can make PIX, wire transfer, payment slip and withdrawals at authorized terminals. In addition, an application refund systemthat is, in some transactions it is possible to get some of the money back.

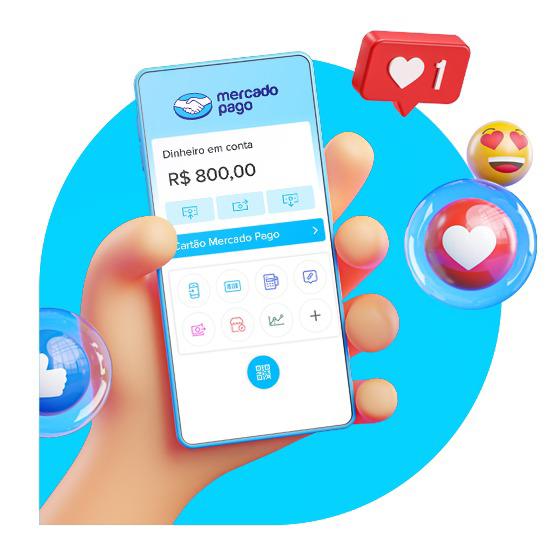

Mercado Pagos

HE Mercado Pagos (Available for Android and iOS) also offers a mod free account for minors, in this case from the age of 13. In addition to getting a free Visa debit card, teenagers can make transfers, withdraw money (at authorized terminals), top up their mobile phone balance and even buy a transport ticket in the app.

The young person can initiate the account opening process, but requires permission from a responsible adult. For this, the mother, father or legal guardian must also have a Active account at Mercado Livre or Mercado Pago.

Z1

Unlike other listed banks, Z1 There are versions for Android and iOS and only one created specifically to offer digital accounts for children and young people. This completely free option also offers debit card issuance, voucher payments and transfers (including PIX). As expected, permission from a responsible adult is required to complete the account opening process.

The biggest difference of the Z1 account, “credit” functionit is nothing but a prepaid card that works in the credit function. In this case, all purchases made with credit are limited to the balance in the account.

Financial education in the palm of your hand

Now that you know some of the best digital banking options for minors and what it takes to open an account, it’s time to get down to business. Just choose one open a digital account for a minor and begins to help develop financial education and encourage the habit of investing.

Source: Tec Mundo