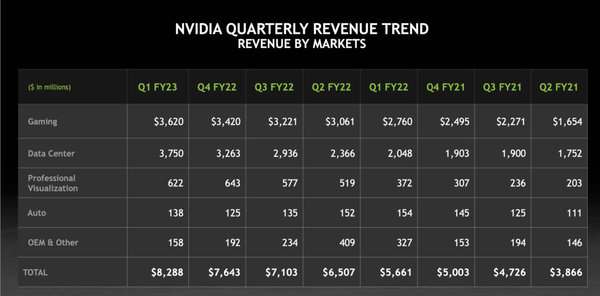

According to the latest figures for the first quarter of 2023, Nvidia managed to break the revenue record once again last quarter. The green camp has never had such a high turnover of US$8.29 billion. Compared to the same quarter of the previous year, there is an increase of 46 percent. However, Nvidia’s market cap fell on Wednesday, in part because the outlook was less rosy.

The record sales were made possible, in part, by strong growth in the company’s data center and gaming divisions. The industries generated record sales of more than US$3.75 billion and US$3.6 billion, respectively. These are 83 percent and 31 percent increases, respectively, compared to the same quarter of the previous year. In his own words, overall turnover has been reduced by nearly half a billion dollars due to the conflict in Ukraine and the ongoing quarantines in China.

Nvidia doesn’t have very high expectations for the next quarter; The company expects revenue of US$8.1 billion for the second quarter of FY2023. This is partly due to the extremely high operating costs that likely followed the chip shortage. The same problems are now reflected in the numbers. In the quarter, Nvidia had about $9.6 billion in “open purchases of stocks and other long-term bonds.” That was less than $3.5 billion last year.

Nvidia’s share fell nearly $17 on Wednesday, in part due to escalating supply issues, geopolitical complications, and the subsequent poor forecast for the second quarter. That’s a 10 percent drop from its all-time low. After stabilization, the company appears to have dropped roughly 7 percent in value.

Source: Nvidia (.pdf)

Source: Hardware Info