BBVA application has been renewed with AI’s great innovations

BBVA application is renewed with new functions and features by taking advantage of AI, discovering the new presented by CEO Onur Genç

BBVA application was completely renewed in Spain using AI and encouraging the very punctual financial objective, such as savings. Very possible Soon other countries benefit from it According to the press release, the code is “unique, scaled and exported” to all places where the bank operates. In addition, the user’s experience will develop radically to make faster payments and with direct access to each of the cards.

- IPhone applications

- IPad applications

- Best application iPad notes

- Blink applications on iPhone

- IPhone video editor

- Applications to watch TV on iPhone

- Applications to watch football on iPhone

BBVA Spain is at the forefront with other financial advantages as well as a renewed application containing AI.

Onur Genç, CEO of BBVA, It is important to confront the commitment with the commitment to “the customer’s point of view”. In everything they do. BBVA users will immediately notice that a new visual identity, color, typography and style have changed completely. If you are tired of being a slow application already, it now assumes that it is six times faster than the previous version. Interestingly, they will put pressure on Apple in terms of their own digital portfolios, because they will integrate their own wallets To access each of the cards or send a “strange” to frequent people. In order to give more safety in its portfolios, each user must be confirmed by his own biometry, ie the face ID or Touch ID.

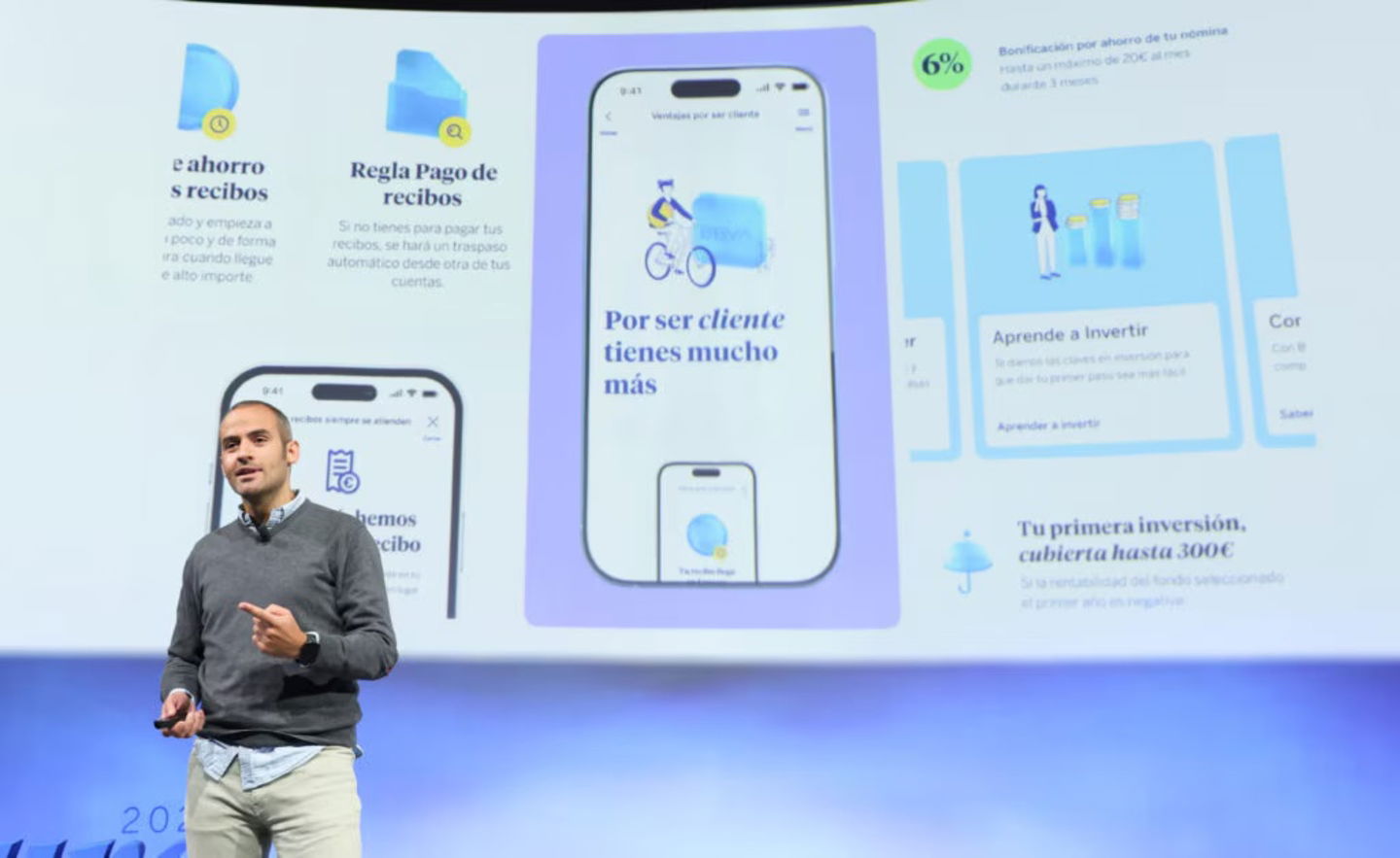

Onur Genç in the presentation of the new BBVA application in Spain

As for artificial intelligence, BBVA application will benefit from Apple Intelligence Technology To such a degree Users can edit the application according to their habits. They can create a personalized design for special digital cards for iPhone 15 Pro and iPhone 16 users. The blue virtual assistant will have a much more natural language from now on, and is renewed, In addition to adding a new “financial coach” that will propose actions to improve your financial situation. BBVA shows that they will come to future updates to reach all customers in the coming days and weeks.

More vehicles to invest or pay receipts

BBVA customers in Spain will receive support from the bank as an incentive. By Axplo, Customers will automatically have the scope for a discovery up to 300 euros to pay any receipt if there is no existing balance.. The application will follow the movement in question and Alternatives will have to meet payment in order to obtain good financial habits.. It will be subject to customers who can meet some unidentified requirements.

BBVA shares users to support users with payment receipts or investments

On the other hand Users who want to invest for the first time will also be a bonus of up to 300 euros. Perform a producing movement Negative profitability in the first investment. Each of the doubts that users have in this regard can consult with the application or reliable consultants.

You can follow iPadizat Whatsapp on Facebook, Twitter (x) Or consult our Telegram channel to be up -to -date with the latest technology news.

Source: i Padizate